China’s sales of new homes dipped by 3.6 percent in February

Growth in sales of real estate in China fell to 2.8 percent during January and February 2019 compared to the same period a year ago, with the value of new property sales during the two months totalling RMB 1.28 billion, according to data released on Thursday by the National Bureau of Statistics.

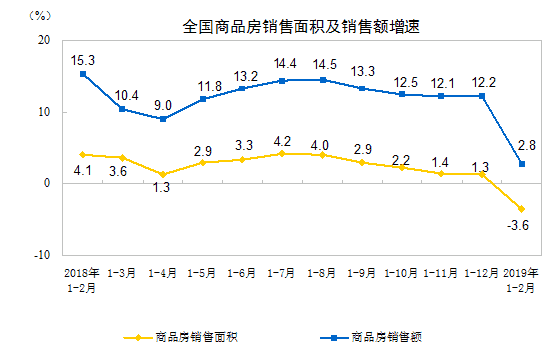

The slowdown in the value of real estate being sold was a drop of 9.4 percentage points from the 12.2 percent annual growth pace recorded in December 2018, and may help to explain recent government moves to open up China’s monetary taps while local authorities begin to loosen sales policies and allow cheaper mortgages.

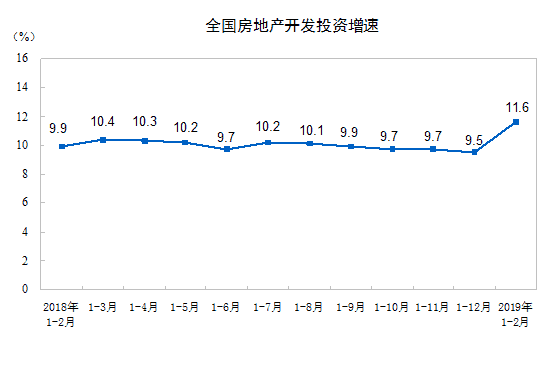

The change in government direction seems to already be understood by developers, who increased the amount invested in the real estate sector by 11.6 percent in January and February compared to the first two months of last year — the biggest surge in commitments to the sector in five years.

Sales Growth Slides

The NBS’ latest data indicated that, in addition to the declining growth in the value of homes sold, property sales by floor area fell 3.6 percent year-on-year in the first two months of 2019, declining to 1.41 million square metres. That slide in the amount of space transacted came after the volume of square metres sold had grown by 0.9 percent in December.

China’s real estate sales growth by value (in blue) slowed by 9.4 ppt in Jan-Feb. Source: NBS

The volume numbers included a dip of 3.2 percent in the residential sector, excluding subsidised housing, while sales of office and retail properties declined 15.7 percent and 13.6 percent by volume respectively.

Overall sales of real estate during the period reached RMB 1.28 trillion, with residential sales posting 4.5 percent growth, office sales dropping by 6.2 percent and retail property sales falling by 9.4 percent, according to the government statistics.

Local Governments Loosen Policies

The slowing sales of homes, and the dependency of Chinese local governments on land sales for the majority of their revenues, appears to already have led to changes in how real estate rules are implemented in many cities.

“Local authorities, feeling that price growth has now come under control and wanting to encourage transaction volumes in support of local market and cash-strapped developers, are selectively loosening some of the more stringent restrictions while banks are starting to reduce the cost of financing in selective cities,” analysts from property consultancy Savills said in a research note issued in response to the latest government real estate statistics.

Some southern cities, such as Guangzhou, along with Heze in Shandong province, have been loosening curbs on the property market since late last year amid slowing sales and bearish sentiment.

Despite the changes happening at the local level, China’s Minister of Housing and Urban Rural Development, Wang Menghui, vowed this week to avoid a “big rise and big fall” in property prices.

Investment Surge Follows Liquidity Boost

The slowdown in China’s real estate sector, which is responsible for 20 percent or more of the country’s economy according analyst estimates, may have already been recognised by top decision-makers who have pumped liquidity into markets this year.

New property investment jumped by the biggest margin since 2014. Source: NBS

The NBS data showed that property investment in China rose 11.6 percent in the first two months of the year, compared to the same period a year earlier, up from the 9.5 percent growth reported for the 2018 full year.

Total investment in the sector reached RMB 1.21 trillion during January and February, after China’s central bank lowered the reserve ratio requirements at the nation’s banks by an average of 100 basis points during the first week of January.

That RRR cut, the fifth such reduction in the amount of cash that banks must hold in reserve in a one-year period, had the effect of freeing up around RMB 779 billion for new lending.

In the nation’s subsequent real estate investment surge, commitments to the the residential sector accounted for 72.1 percent of the total and represented an 18 percent increase in investment compared to the same period the previous year. The trend marked the strongest growth for the January-February period since 2014, when it rose 19.3 percent, according to Reuters.

The NBS said that robust investment in the property sector was due to steady housing prices and an increase in new construction starts.

Leave a Reply