While China’s luxury retailers fell well short of their goals in 2013, the major cause of the industry’s struggles was poor planning, not a government clampdown on bribery and draft, according to a survey conducted last week on Mingtiandi.

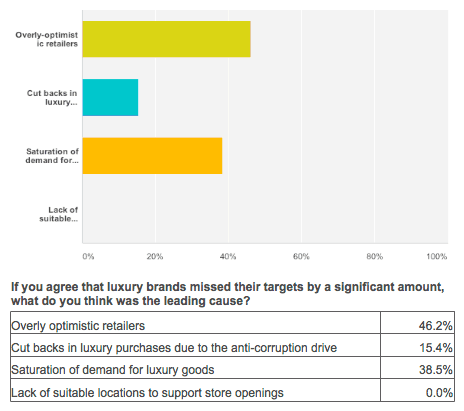

Among the survey’s respondents, the major reason cited for retail store openings missing their targets in 2013 was “overly optimistic retailers” which was cited as the leading cause of the shortfall by 46.15 percent percent of respondents. Only 15.4 percent of the professionals responding to the poll saw cutbacks in luxury purchases due to the anti-corruption drive as the leading cause of the luxury sector’s struggles last year.

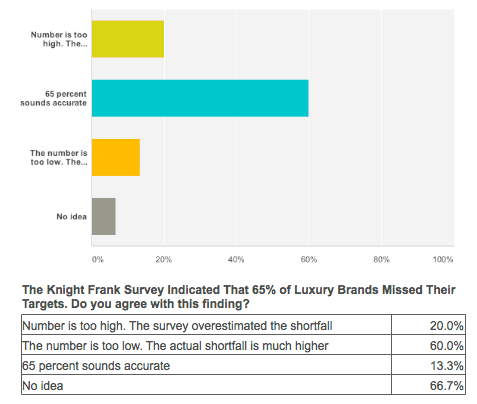

The poll was conducted in response to a report from real estate consultancy Knight Frank which found that 65 percent of luxury retailers failed to reach their targets for new store openings in 2013.

Among the respondents to the Mingtiandi survey, 60 percent agreed with the figure cited by Knight Frank, while 20 percent believed that 65 percent was an overestimate of the industry’s shortfall, and 13.3 percent thought that the 2013 shortfall was significantly greater than the 65 percent found in the report.

Figures from consultancy Bain & Company estimated that spending on luxury goods in China expanded by only about 2 percent in 2013, compared with 7 percent the previous year. China’s overall retail sales increased 13 percent last year compared to 2012, according to figures from the National Bureau of Statistics.

Media reports, which often cite comments from luxury brand executives, have been quick to place the blame for last year’s disappointing results on the Xi Jinping government’s anti-corruption drive. The campaign has sought to improve the Communist Party’s public image by reining in obvious displays of ill-gotten gains such as officials driving luxury cars or their girlfriends’ carrying designer handbags.

One retail real estate professional who responded to the survey commented, “Too many retailers were looking at their past sales growth and projecting the rate of increase to continue even as they opened more outlets in more cities.”

Outlook for 2014 Shows Little Love for Luxury

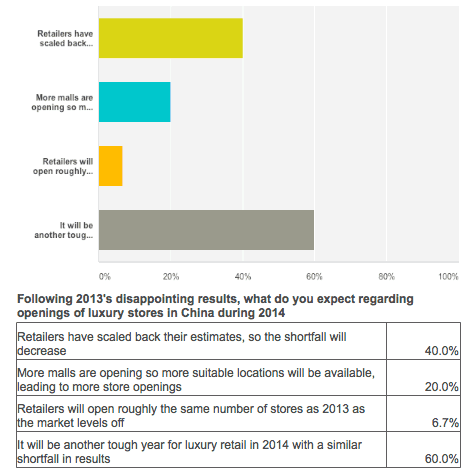

The new year could be bringing further disappointment for sellers of high-end goods, as the survey respondents saw little chance of the market improving significantly in 2014.

A majority of respondents believe that luxury retailers will again miss their expansion targets, with 60 percent predicting that “it will be another tough year for luxury retail in 2014, so the shortfall will decrease.” Another 40 percent of respondents indicated that brand owners will come closer to reaching their targets this year, but only because they have already scaled back their expectations.

About the Survey

The luxury retail real estate survey was conducted on Mingtiandi’s website for four days, from March 4th to March 7th, and received responses from 15 visitors to the site. Among the respondents, 60 percent identified themselves as China retail real estate professionals, with another 20 percent indicating that they followed the sector professionally as an investor or analyst. Another 20 percent identified themselves as casual observers of the market.

The survey was the first installment in what is expected to be a regular feature on the website.

About Mingtiandi

Mingtiandi is China’s independent source of real estate market intelligence and was visited by more than 3000 professionals during February. The company’s email newsletters reach more than 2000 real estate and financial professionals each week, including institutional investors, fund managers and corporate real estate managers.

Leave a Reply