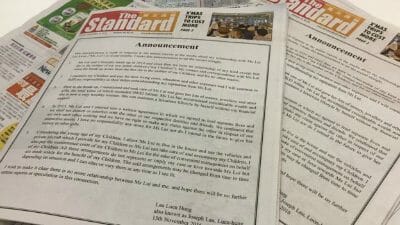

Most people use Facebook to update their relationship status. Joseph Lau buys full page print ads

Announcing a break up is hard to do. Some people privately tell their friends while others take to social media to update everyone on their relationship status. Of course, when you’re a fugitive Hong Kong property tycoon like Chinese Estates boss Joseph Lau, you also have the option to take out a full-page ad in five newspapers to declare your new independence.

Lau’s announcement ad confirmed he broke up with Yvonne Lui Lai-kwan in 2014 and his since supported the two children they had together with money going directly to his ex-girlfriend. The ad also explained how the mogul convicted of corruption in Macau in 2014 lavished his ex with more than HK$2 billion ($257 million) in jewelry, gifts and cash during their time together.

His relationship with the one-time Miss Hong Kong semi-finalist has continued to make headlines as she and their two children live in his house and, thankfully, are able to still make use of the property magnate’s private 787. According to Lau’s ad, that is all done for the kids’ well being.

And while the controlling shareholder of Chinese Estates was willing to spend $48.4 million on a 12.03-carat diamond dubbed “Blue Moon” for his seven-year-old daughter, he was pretty frugal on the design of the ad which looks to be nothing more than a Microsoft Word document.

Lau now accuses Yvonne Lui Lai-kwan of being a bit too commercially inclined

Lau Slams Greedy Ex In Video

One day after the ad was published, the man wanted for money laundering in the gambling haven appeared in a video interview confirming he was the one behind the announcement. And like most people after a failed relationship, he didn’t hesitate to take a few cheap shots about his former partner.

“But Lui Lai-kwan has been asking for money with different excuses. And she never got enough,” he was quoted as saying by Apple Daily. “Even you give her HK$10 billion, she will still betray me for HK$1 … she’s greedy forever.”

All’s Fair In Love And Real Estate

It’s safe to say Lau won’t be the first nor the last person involved in real estate to go through a messy breakup. In fact, the $257 million he lost pales in comparison to what co-founder and chair of Longfor Properties, Wu Yajun, handed over to her partner when they split in 2012.

As part of the divorce settlement, Wu gave ex-husband Cai Kui a 30 percent stake in the Hong Kong-listed firm that cut her net worth by $2 billion, according to Forbes estimates.

Developers may think breakups are expensive, but it is the only way some buyers can afford to purchase a house in China. Couples started turning to divorce in order to purchase homes in some of the country’s overheated markets like Shanghai.

There is hope for us all, however. Real estate power couple Pan Shiyi and Zhang Xin are still going strong leading SOHO China and giving to various charitable causes.

Leave a Reply