Office rents in Beijing’s central business district held steady in 2013, but even holding your own can make you stand out sometimes, as China’s capital became the world’s fourth most expensive place to rent an office.

According to the Office Space Across the World report issued by real estate consultancy Cushman & Wakefield, in the 2013 world rankings of the most expensive office locations Beijing’s CBD surged from seventh position in 2012 to fourth for last year, despite flat rental rates.

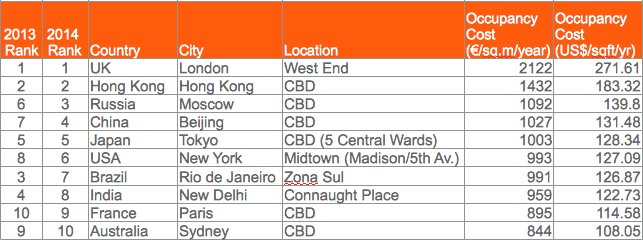

London’s West End is the world’s most expensive office market for the second year in a row, retaining its title ahead of runner-up Hong Kong, according to the report.

Top 10 Most Expensive Locations

Beijing Rents Remain Steady

China has consistently been at the height of office demand within the Asia Pacific region. However, continued economic uncertainties combined with easing GDP growth has slowed occupier interest.

As the most expensive office market in China, Beijing had two years of massive prime rental growth in 2010 and 2011; however, in 2012, prime Beijing CBD rents were actually unchanged over the year. The Beijing office market is still in a landlord led situation, and this trend should continue for the next 2-3 years as a result of the scarce future supply in core submarkets.

During 2013, occupiers began balking at the steep rents within central Beijing, and the surplus of space available in the non-core submarkets allowed tenants to find lower-cost alternatives available in secondary areas away from downtown. The overall impact for Beijing’s was that rents in Beijing’s CBD remained steady during the past year.

Shanghai Rents Slid During 2013

In Shanghai, prime rents in West Nanjing Road slipped by 6%; however, market sentiment remained relatively optimistic.

James Shepherd, Executive Director & Head of Research for Greater China at Cushman & Wakefield, commented: “Although conditions weakened last year, both Beijing and Shanghai remain some of China’s most important office markets for domestic and multinational tenants, and as a result, these locations are still among the most expensive markets within the region.”

Growth Slows in APAC But Beats Global Average

Rental growth was largely flat across Asia Pacific over the year, with an overall regional rental rise of just 2% in 2013. Economic conditions were more fragile in the first half of the year, although growth in China and Japan advanced as the year progressed.

Rents in Hong Kong’s Central Business District remained largely unchanged compared to 2012, but retained its position in second place overall,

Asia Pacific’s performance in 2014 is anticipated to be similar to that seen in 2013, with slow and stable demand anticipated to keep rental levels largely unchanged, albeit with incentives becoming more competitive.

For 2014, the region is expected to remain on course for continued growth in line with the past year. The key economies of China, Japan and Southeast Asia are anticipated to drive the region forward, with demand for office space in these countries gaining momentum over the year.

Growing Globally for the Third Straight Year

Global office rents moved up by 3% in 2013, the third consecutive year of similar rental performance, with Europe, Asia and the Americas all witnessing mild rental growth over the year.

Leave a Reply