Asia-Pacific commercial real estate (CRE) markets are set to benefit from a structurally thinner development pipeline over the next several years, creating a multi-year window for vacancies to fall and rental growth to re‑emerge.

Asia-Pacific commercial real estate (CRE) markets are set to benefit from a structurally thinner development pipeline over the next several years, creating a multi-year window for vacancies to fall and rental growth to re‑emerge.

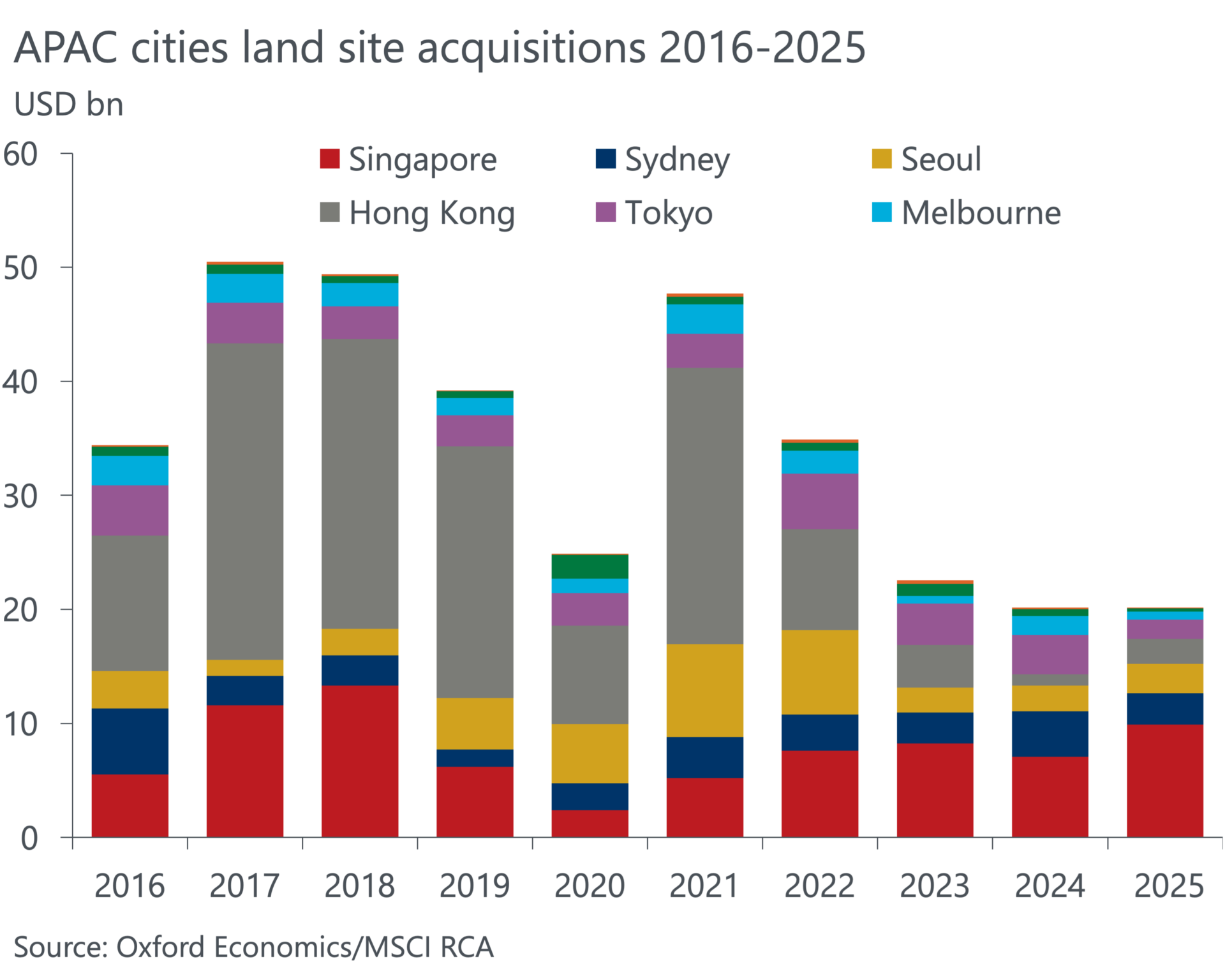

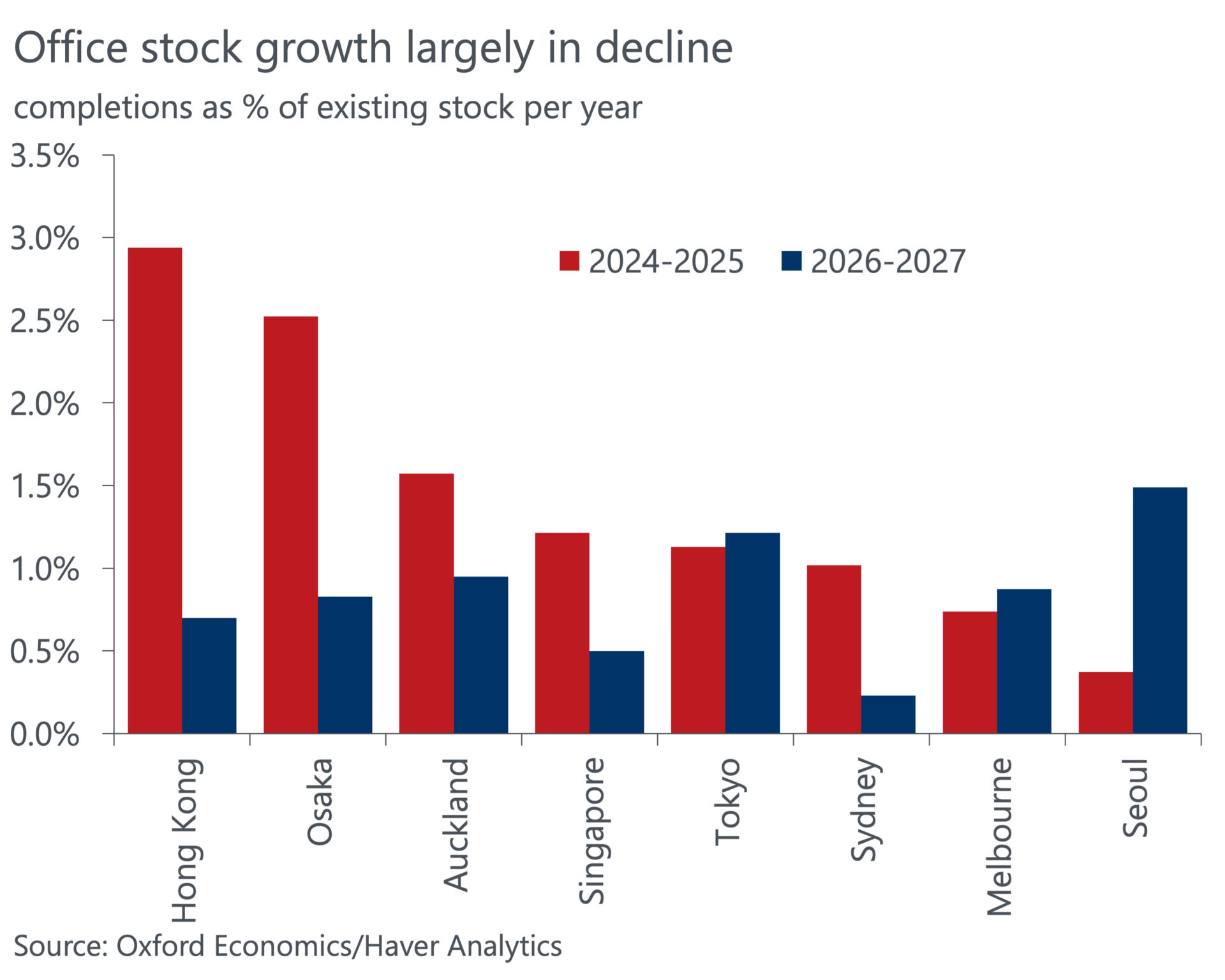

Elevated construction costs, tighter financing conditions, regulatory delays and labour shortages have materially weakened project feasibility, leading to fewer new starts and a thinner forward supply outlook. This adjustment is creating a near term window for operating fundamentals to improve. With typical development timelines spanning two to four years, the slowdown in land acquisitions over the past three years is now feeding through into lower completion volumes across the region. As a result, most markets are entering a period where demand has time to catch up with existing stock, allowing vacancy rates to trend lower and effective rents to stabilise, even against a relatively subdued macro backdrop.

New supply is being delivered unevenly across cities rather than uniformly across the region. In markets where vacancy remains tight, such as Tokyo and Seoul, development activity has held up, supported by strong demand and surging rental growth, therefore improving feasibility. In contrast, cities with softer demand conditions or elevated vacancy, including Hong Kong and the major Australian office markets, are seeing a much sharper pullback in new supply. This uneven distribution is reinforcing divergence across Asia Pacific, with development gravitating toward markets that can absorb it and retreating where it is least needed.

Hotels are among the clearest beneficiaries of this environment. Inbound tourism across Asian cities is expected to grow materially faster than new room supply over the coming five years. Overnight stays are forecast to rise at just over 5 percent per annum, compared with hotel stock growth of less than 2 percent. This imbalance should support further gains in occupancy and average daily rates, particularly in Singapore, Hong Kong and Seoul, where international travel has normalised and development pipelines remain limited.

Residential and industrial markets present a more mixed outlook. Australian residential markets remain structurally tight, with household formation driven by net migration rates continuing to outpace new completions. Hong Kong is approaching a stabilisation phase as household growth begins to absorb excess inventory and rents show early signs of firming. Industrial markets are moving toward a more balanced position after several years of rapid expansion, with oversupply pressures now largely confined to specific submarkets rather than being systemic.

Looking further ahead, there are potential pockets of risk. Seoul’s office market is expected to see a larger wave of completions from 2028 onwards, which could lift vacancy, while at the same time labour force demographics will deteriorate. Singapore also faces a more modest increase in office supply later in the decade as major redevelopment projects complete, potentially increasing backfill space and softening conditions at the margin. These risks are not immediate, but they do place a natural time limit on the current window of tightening fundamentals.

Overall, Asia Pacific real estate investment is shifting into a more income driven phase of the cycle. Supply discipline is becoming a defining feature across most sectors, favouring existing assets over new development. Performance will increasingly be shaped by local supply dynamics, demographics and capital costs, making selectivity and timing critical as the cycle evolves.

Leave a Reply