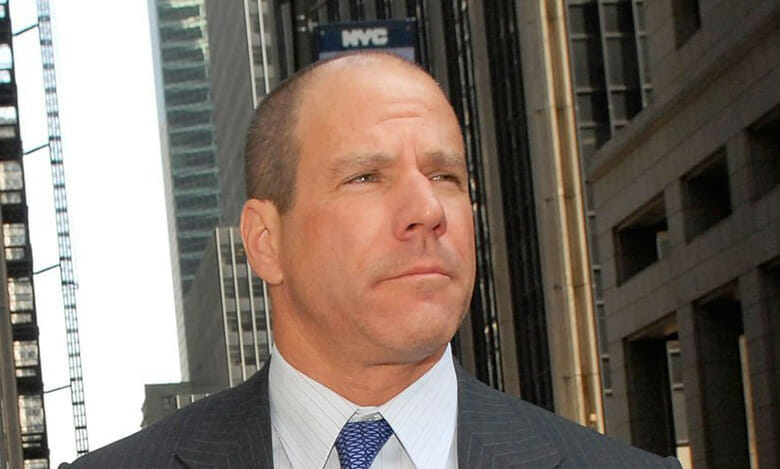

TPG CEO Jon Winkelried is backing digital infrastructure in India (Getty Images)

Data centres lead Mingtiandi’s look at real estate headlines from around the region as TPG agrees to invest $1 billion in a Tata platform. Also making the news today are a Marubeni REIT investing in a mix of Japanese assets and a Daiwa-sponsored trust adding a pair of apartment buildings near Tokyo to its portfolio.

TPG Signs Deal With Tata Unit to Invest $1B in India Data Centres

Tata Consultancy Services secured $1 billion from fund manager TPG to speed its push into AI data centres, underscoring the outsourcer’s bid to gain ground in one of technology’s fastest-growing arenas.

TCS and the US alternative asset manager together will invest as much as INR 180 billion ($2 billion) into the Indian IT firm’s AI data centre arm, HyperVault, over the next few years, the companies said Thursday. The partnership with TPG will help TCS boost shareholder returns, trim its capital burden and build long-term value in the emerging data centre platform, Asia’s largest outsourcer said. Read more>>

Marubeni’s United Urban REIT Announces $244M Investment

Tokyo-listed United Urban REIT said on 17 November that it will acquire stakes in a set of four real estate assets in Japan for a combined price of JPY 38.3 billion ($243.6 million).

The deal gives the Marubeni-sponsored trust ownership in properties in the city of Kobe, as well as in Ibaraki, Gifu and Tottori prefectures, including a JPY 16.8 billion investment in the Aeon Town shopping centre in Moriya city, according to a stock exchange announcement. Read more>>

Daiwa Securities Living REIT Buying Greater Tokyo Apartments for $34M

Daiwa Securities Living Investment Corporation announced to the Tokyo Stock Exchange on 20 November that it has agreed to acquire one apartment building each in the cities of Kawasaki and Yokohama for a total of JPY 5.4 billion ($34.3 million).

The REIT is buying the pair of buildings from its sponsor, Daiwa Securities Realty, with the deal adding a total of 139 units to the trust’s portfolio, according to the announcement. Read more>>

Sydney’s Assembly Reopens Value-Add Fund After Melbourne Mall Buy

Sydney’s Assembly Funds Management, a property investor led by former Westfield chief operating officer Michael Gutman, has reopened its second property fund as it seeks to stock up on dry powder for the new year.

Potential investors have been told that the Assembly Diversified Property Fund 2 will run a rapid-fire fundraising round from mid-November until Christmas, after the vehicle had raised A$165 million of its A$350 million ($226 million) target since launching two years ago. Read more>>

KKR Said Targeting $15B for Japan and India Focused Asia Fund V

KKR is aiming to raise $15 billion for its latest Asia fund, according to people with knowledge of the matter, with the new vehicle set to target opportunities in Japan and India with plans to gather a fund that would match the size of the prior vehicle, Asia Fund IV.

KKR said on 7 November that it would pay back $350 million in fees on its second Asia fund because of under-performance and take a charge in the fourth quarter. That fund reported a net internal rate of return of negative 1.5 percent as of 30 September. Read more>>

Mainland Finance Boss Buys Hong Kong Luxury Home for $74M

A company associated with Vincent Gao, the founder of Hong Kong-based hedge fund CoreView Capital, has bought a luxury home in the city’s Southern district for about HK$579 million ($74.3 million), according to official records.

Matrix Properties was identified as the buyer of House 6 at the upscale development 15 Shouson Hill in one of the city’s most exclusive enclaves, Land Registry documents showed. Read more>>

Macau’s SJM Cancels Casino Acquisition

Integrated resorts operator SJM Holdings, one of the six licensed casino concessionaires in Macau, has abandoned a plan to acquire Ponte 16, which is among the firm’s nine satellite gambling venues directed to halt operations under the city’s revised gaming laws.

“Following a comprehensive business review and after a thorough assessment of long-term business planning, commercial considerations and resource prioritisation across the group’s portfolio, SJM Resorts will not proceed with the acquisition,” the Hong Kong-listed company’s principal subsidiary said in a statement on Thursday. Read more>>

China Weighs Fresh Property Stimulus as Housing Slide Continues

China is considering new measures to turn around its struggling property market, as concerns mount that a further weakening of the sector will threaten to destabilise its financial system, according to people familiar with the matter.

Policymakers including the housing ministry are considering a slew of options, such as providing new homebuyers mortgage subsidies for the first time nationwide, the people said, asking not to be identified discussing a private matter. Other measures being floated include raising income tax rebates for mortgage borrowers and lowering home transaction costs, one of the people said. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on X, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply