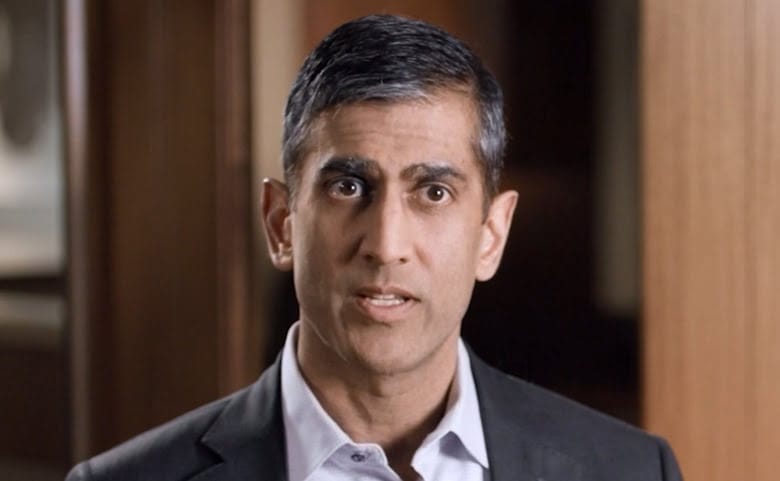

Raj Agrawal, global head of real assets at KKR (Image: KKR)

KKR has received a $40 million commitment from a Texas pension manager for the private equity giant’s latest Asia Pacific infrastructure strategy.

The new fund, Asia Pacific Infrastructure Investors III, began taking commitments in June and builds on Manhattan-based KKR’s infrastructure franchise with over $83 billion in assets under management globally. The Employees Retirement System of Texas revealed its commitment in a disclosure late last week.

The vehicle is the follow-up to Asia Pacific Infrastructure Investors II, which last year reached a final closing of $6.4 billion — including a $50 million commitment from ERS in 2022 — and was billed by the US firm as the largest pan-regional infrastructure fund ever raised for APAC.

Austin-based ERS didn’t disclose particulars about the new fund, but sources told data platform Ion Analytics in May that the pan-regional strategy was targeting to raise from $7 billion to $9 billion and would invest in sectors including data centres, utilities and transport. KKR didn’t respond to Mingtiandi’s request for comment on the fund.

STT Data Centres Bid

Bloomberg reported two months ago that KKR was in talks to buy ST Telemedia Global Data Centres in a deal that could value the platform at more than $5 billion, with the US firm understood to be holding a 14.1 percent stake in the Singapore-based operator at the time.

Employees Retirement System of Texas chairman Craig Hester

In June of last year, KKR and Singapore telecom operator Singtel had agreed to invest as much as $2.2 billion for up to an 18.3 percent combined stake in STT GDC, a platform with operations in key markets of Asia and Europe. The companies invested an initial S$1.75 billion (then $1.29 billion) in STT GDC, with KKR making its investment from Asia Pacific Infrastructure Investors II.

KKR and other fund managers pledged at last year’s Indo-Pacific Partnership for Prosperity to invest $25 billion to develop infrastructure in the Indo-Pacific region. KKR had committed up to S$1.1 billion for a 20 percent stake in Singtel’s Nxera regional data centre business in September 2023, and the US firm acquired an additional stake in Philippine cell tower operator Pinnacle Towers for $400 million in March 2024.

KKR’s infrastructure funds have also invested in Indian clean energy platform Serentica, Indian renewables provider Hero Future Energy and Japanese pharmaceuticals contract manufacturer Bushu Pharma, according to Ion Analytics.

Key Allocation

ERS, a $40 billion pension fund for Texas government workers, set up its infrastructure programme in 2013 and has made the asset class a priority of the trust with a target allocation of 5 percent.

Digital infrastructure, including data centres, represents about one-third of ERS’s infrastructure portfolio, according to meeting minutes from May.

The infrastructure portfolio has stabilised at a roughly 12 percent return compared with an 8.5 percent benchmark and is slightly over allocated at 6.4 percent but trending back towards the 5 percent target, said Pablo de la Sierra Perez, infrastructure director at ERS.

ERS’s other capital commitments in the June-August period included $75 million earmarked for ISQ Growth Markets Infrastructure Fund II, an opportunistic vehicle managed by Miami-based I Squared Capital.

Leave a Reply