Real estate investors in Asia Pacific are adopting more active management strategies and venturing into more specialised sectors to achieve a returns in a challenging environment, according to a recent survey conducted by Vistra Fund Solutions and the Asia Pacific Real Assets Association (APREA).

Real estate investors in Asia Pacific are adopting more active management strategies and venturing into more specialised sectors to achieve a returns in a challenging environment, according to a recent survey conducted by Vistra Fund Solutions and the Asia Pacific Real Assets Association (APREA).

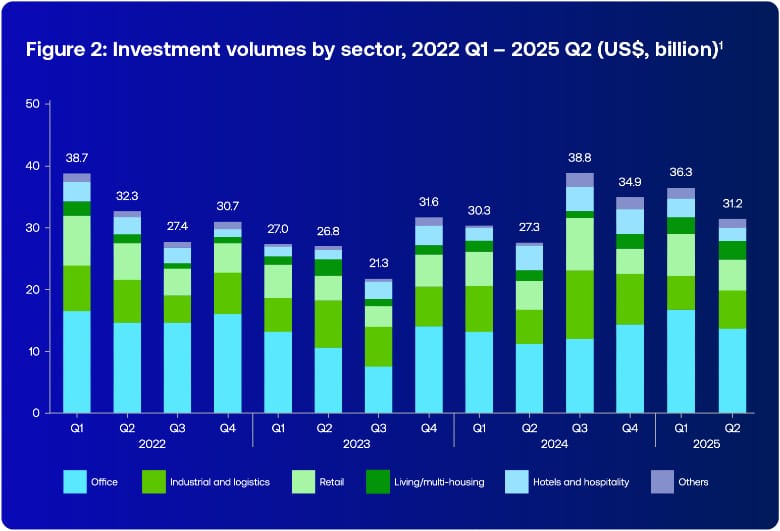

In a survey conducted in the second quarter, Vistra and APREA found that with interest rates coming down and inflation looking tamed in more markets, commercial real estate investment can be expected to increase by 5 to 10 percent in 2025, but with investors turning to new strategies and sectors to drive returns.

Based on the findings of the survey, the authors have published the inaugural Vistra Fund Solutions Friction Index, which examines the most favoured strategies being pursued by institutional real estate investors in Asia Pacific, as well as the challenges which they are encountering in executing on those strategies.

“This white paper provides a comprehensive analysis of APAC real asset market trends and insights. The Vistra Fund Solutions Friction lndex is based on a survey conducted in conjunction with APREA of senior real asset investors with offices in APAC. It provides a strategic framework to understand both sentiment and the future direction of investment in various sectors and geographies region-wide. In 2025, the real asset market has shown resilience, with multiple sectors experiencing notable performance. Investors are increasingly drawn to high-potential opportunities that often also come with significant friction including regulatory, tax, and operational challenges.

Strategic and proactive investors who can adeptly navigate these challenges are well-positioned to capitalise on market upside.

With this report, we aim to provide valuable insights to help real asset investors understand and navigate the intricacies of the current market and ultimately enable them to make informed decisions that drive success”, said David Anderson, executive vice president for APAC at Vistra Fund Solutions.

David Anderson, Executive Vice President, Fund Solutions, APAC, Vistra Fund Solutions

With the survey having gathered responses from more than 100 C-suite APREA members and Vistra clients investing in real assets across Asia Pacific, the poll brought in information regarding 10 asset classes across 12 key markets in the region, providing insights into the challenges and opportunities which players in the market are focused on this year.

Cautious Optimism Prevails

With the market still adjusting to the shift from an extended period of low interest rates, the survey found that investors remain guarded about the near to medium-term outlook.

Regarding finding real asset investment opportunities in the region over the next one to two years, 39 percent of respondents gave a “neutral” response and 36 percent indicated that they are slightly optimistic. Just 13 percent are highly optimistic while 12 percent said that they are slightly or highly optimistic.

Value-Add and Opportunistic on the Rise

While core and core-plus strategies once were the most favoured approached to real estate investment in Asia Pacific, the need to achieve yields in a higher interest rate environment, and new concerns regarding risk have brought real estate credit, value-add and opportunistic strategies nearly on par with core.

The survey results show core maintaining a lead of just a few percentage points over other strategies, with 63 percent of respondents ranking the approach within their top three, among core, real estate debt, opportunistic and value-add.

By comparison, 59 percent of respondents selected real estate debt among their top three, with 56 percent including opportunistic and both value-add and distressed asset strategies being included by 53 percent of respondents.

The authors pointed to the growing popularity of value-add and opportunistic strategies as illustrating the growing preference for higher yielding bets which require active management to create value and take advantage of assets facing challenges.

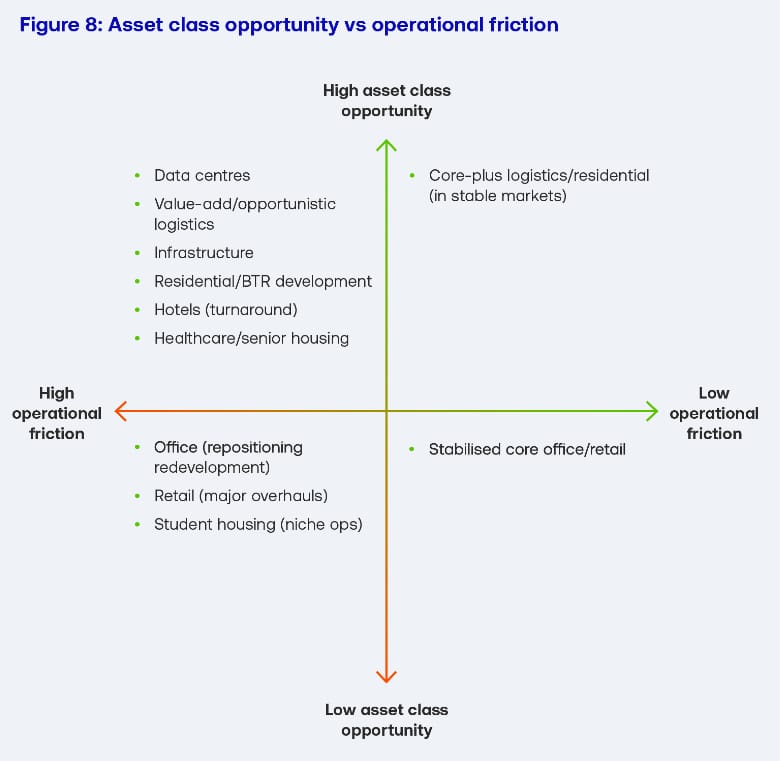

Data Centres and Industrial Lead

Among asset classes, the report found investors showing a strong consensus in favour of logistics and industrial as well as data centres, with strategies favouring these assets scoring points for their upside potential. For logistics demand, Singapore saw the highest activity in the region, leading Asia Pacific in both inquiries and site visits.

Next most favoured were rental residential assets, including multi-family and build-to-rent, in addition infrastructure.

Trailing as options were traditional commercial mainstays office and retail, which ranked at the bottom of investor preferences.

Market Friction Issues on the Rise

With investors moving into more active sectors, and with emerging market plays becoming more common, the survey also highlighted challenges from the “friction” of investing as a dominant theme in the industry. With investors facing regulatory hurdles, tax complexity, and operational challenges in the region’s real estate markets, these barriers have become a primary concern.

Respondents pointed to frustrations from navigating complex and unclear regulatory environments, political risk, a lack of transparency, and the difficulty in finding good deals as major hurdles to achieving successful investments.

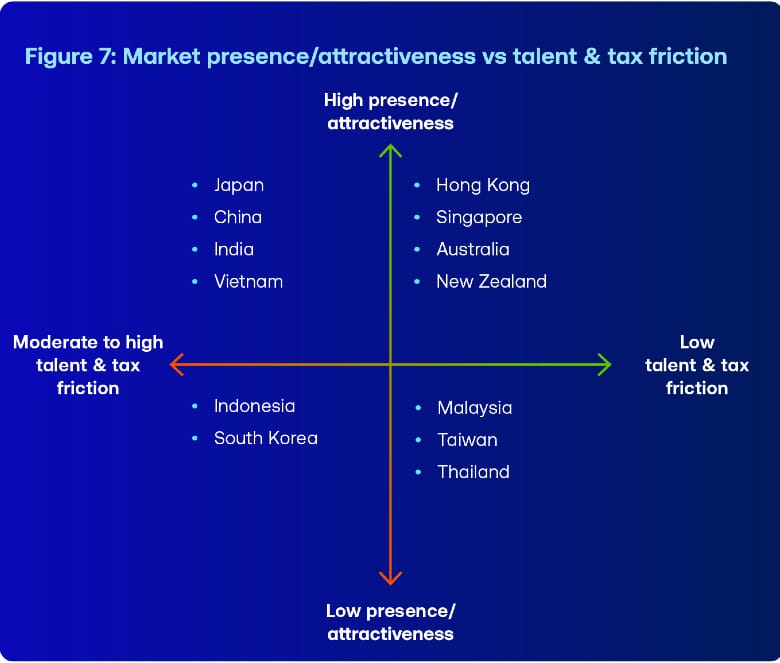

Among markets, India, China, Indonesia, and Vietnam were consistently highlighted as the most challenging jurisdictions with regard to both tax regimes and for hiring and retaining operational talent. Some 47 percent of respondents identified India as having a challenging tax regime, the highest of any market.

Associated with the rising operational challenges facing investors, a strong majority of repondents indicated a desire to outsource complex and resource-intensive functions of their business to improve efficiency.

62 percent of respondents respondents said they prefer to outsource regulatory reporting, 59 percent pointed to tax and audit coordination as functions to be outsourced with an equal percentage indicating that external management of their SPV is an area which they would prefer to hand off to external experts.

“It’s clear that operational friction is slowing momentum across many APAC markets—especially around regulation, partnerships, and tax complexity. When nearly half of respondents say customising fund structures for multiple jurisdictions or accessing reliable performance data is difficult, it’s a signal: scale and local expertise matter more than ever,” said Otto Von Domingo, Managing Director and Head of Commercial for APAC at Vistra Fund Solutions.

Otto Von Domingo, Managing Director, Head of Commercial, APAC, Vistra Fund Solutions

Among the activities cited by respondents as creating significant operational friction were customising fund structures for multiple jurisdictions, ensuring data security and reliability, and navigating cross-border structuring. The respondents also pointed to regulatory ambiguity, political uncertainty, and a lack of market transparency and standardisation as major operational pain points.

AI and ESG Reshaping Operations

The newest force reshaping Asia Pacific’s real estate investment landscape appears to be artificial intelligence with survey respondents seeing a role for the emerging technology in particular aspects of the industry.

65 percent of respondents see AI having the greatest impact on deal sourcing and market intelligence, with systems for improving operational efficiency ranking second at 55 percent, pointing to a drive to use technology to gain a competitive edge and streamline processes.

ESG is also a major element of asset management operations, according to the survey, with 65 percent of respondents ranking ESG as “important” to “extremely important,” confirming its integration into the investment decision-making process. However, 35 percent of those polled still see ESG as only “slightly important.”

Friction Accompanies Opportunities

In reviewing the results of the Vistra Fund Solutions Friction Index 2025, the authors pointed to a paradox defining APAC real asset investing in 2025 – that the most promising opportunities often come with the highest levels of operational friction.

As investors move beyond passive strategies to more active approaches in pursuit of returns, and often are venturing into less familiar markets such as Japan, China, India and Vietnam.

Given the tax complexity, regulatory opacity, and talent shortages which persist in these markets, success more than ever depends on investors ability to execute and their ability to partner with organisations with local, industry-specific expertise.

Streamlining reporting, embracing AI-driven tools, and outsourcing high-friction functions like compliance, tax, and fund administration are seen as ways investors can free up teams to focus on core functions and succeed in what remains a challenging environment.

Leave a Reply