Despite six months of protests and a year-long slide in home prices, many Hong Kong residents are regaining confidence in the city’s housing market, according to a survey published this week by Citibank.

Despite six months of protests and a year-long slide in home prices, many Hong Kong residents are regaining confidence in the city’s housing market, according to a survey published this week by Citibank.

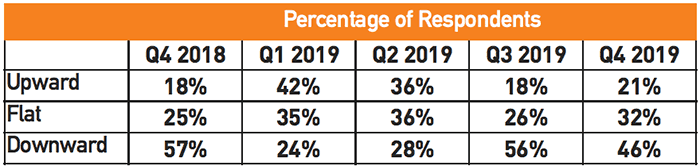

While Hong Kongers remained skeptical toward buying a home in the world’s most expensive real estate market some 46 percent of subjects responding to the survey in October said that they expected home prices to fall in the next 12 months – down from 57 percent of those surveyed three months earlier.

“The results show that although most respondents were expecting property prices to fall in the next 12 months and did not consider now a perfect time to buy a home, the percentage of respondents holding this view has declined by about 10 percentage points from the preceding quarter,” Josephine Lee, Head of Retail Banking at Citi Hong Kong said in a statement.

The polling for the quarterly research project was conducted during the same month that Hong Kong’s chief executive in her annual policy address announced measures designed to make it easier for city residents to buy their own homes, after local authorities targetted high housing prices as a potential source of ongoing unrest in the community.

How Do You Think Home Prices Will Trend in the Next 12 Months?

Source: Citibank

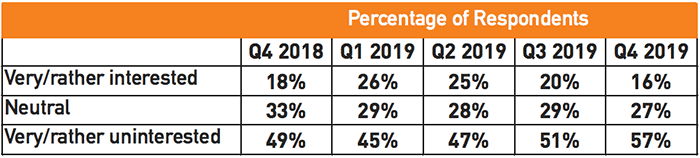

Interest in Home Purchases Slides in 2019

While local residents are showing less negativity toward the prospects for property pricing, interest in buying a home continues to fall, with only 16 percent of respondents indicating that they are very or rather interested in purchasing a home now – down from 20 percent during the previous iteration of the report.

57 percent of the respondents told the phone interviewers from the University of Hong Kong Social Sciences Research Centre, which conducted the survey on behalf of Citibank, that they were very or rather uninterested in buying a home now – an increase of 6 percentage points from the third quarter, while 27 percent reported that they were neutral – down from 29 percent three months ago.

How Interested Are You in Purchasing a Property Now?

Source: Citibank

“The interest level in home ownership has also dropped compared with the preceding quarter, reflecting a continued wait-and-see attitude towards the property market outlook,” Citi’s Lee noted. Enthusiasm for home purchases has been falling since the first quarter of 2019, according to the bank’s survey, with 26 percent very or rather interested in purchasing a property during the opening months of the year.

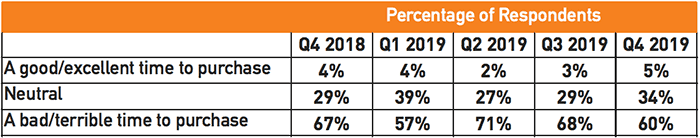

Pessimism Shrinks For First Time Buyers

While the general public continues to find housing in Hong Kong unappealing, the outlook for potential first time homebuyers is becoming less terrifying, according to the survey, although a majority of respondents still describe the current opportunity as bad or terrible.

If You Do Not Own Any Property Now, Taking into Consideration Your Current Standard of Living and Family Finances, Do You Think It is a Good Time to Purchase a Home Now?

Source: Citibank; Base: All Repondents

For people not already owning a property, considering their current circumstances, the percentage of respondents who consider it a good time to buy a home, grew from 3 percent in the third quarter to 5 percent in the fourth quarter edition of the report. Correspondingly, when surveyed in October, 60 percent of those surveyed said it was a bad or terrible time to purchase a home, which while perhaps not encouraging to developers, still represents an improvement from the 68 percent level recorded during the previous iteration of the survey.

Citibank’s Josephine Lee sees buyer sentiment leveling off

While negativity toward opportunities for first-time buyers has been trending downward for two straight quarters, sentiment regarding this segment may have received a boost from the government’s relaxation of mortgage requirements, which were introduced by Lam in her policy address on 16 October.

Under the new policies, first-time homebuyers are now allowed to borrow up to 90 percent of a property’s value on purchases of homes valued up to HK$8 million – doubling the maximum purchase price allowed under the lowest level of downpayment compared to earlier rules.

Prices Predicted to Drop 5% Next Year

Despite the incentive policy for first time buyers, and additional rules introduced by the government relaxing mortgage lending for all potential purchasers, home sales in Hong Kong have continued to struggle.

Local developer K Wah International was only able to find buyers for 128 of the 228 units which it made available in its K Summit project in Kai Tak over the weekend as it launched sales for the luxury development, according to a report in the South China Morning Post.

Last week Knight Frank’s Head of Valulation and Advisory for Greater Thomas Lam predicted continuing price reductions in the new year, as the market avoids a worst case scenario. “We foresee the mass residential home prices will drop slightly by 5 percent in the coming year, but the reoccurrence of the 1997 property market crash is very unlikely,” Lam said in a statement.

Leave a Reply