Author: Thomas Chak, Head of Capital Markets & Investment Services, Colliers, Hong Kong

This year, investors in the Asia Pacific market are preparing for lower interest rates following an extended period of inflation that kept many on the sidelines. Expectations of further rate cuts and narrowing pricing and valuation gaps will likely drive transaction volumes. The US Federal Reserve, however, kept its key interest rate in check in January, its first meeting without a cut since July 2024, as it grappled with increased inflation and the new government. Federal Reserve Chair Jerome Powell told lawmakers on 11 February that interest rates would not change at its March meeting either.

Pipeline Deals Rebound

Higher interest rates made deals challenging to underwrite, leading fund managers to sit on the sidelines. The landscape shifted in September with the Fed’s rate cuts reflected in the spike of pipeline deals in October.

In Hong Kong, recent interest rate cuts and supportive measures from the October 2024 Policy Address have spurred demand from schools and high-net-worth investors. Buyers are more active, negotiating better prices and making more offers. However, sizable fund managers remain cautious, awaiting more apparent signs of market turnaround and easier financing.

Development Challenges

Higher construction costs challenge investors’ target returns, leading some to focus on alternative assets and abandon development plans. Developers are discouraged from bidding for land in public tenders due to development risks and financial difficulties.

Sustainability on Hold

Sustainability initiatives have been temporarily postponed due to economic uncertainty and an emphasis on cost-effectiveness. Green certifications and energy efficiency remain essential, but many retrofit projects have been delayed as building owners deal with low occupancy rates and falling asset values.

Hong Kong’s Investment Market

2024 was another challenging year for Hong Kong’s commercial property sector. The Grade A office sector had an annual supply of 1.5 million square feet and a net take-up of 0.45 million square feet, resulting in a 16.8 percent vacancy rate by year-end. Some 3.63 million square feet are due this year.

Investment sentiment received a modest boost from the rate cut cycle in September and the relaxation of the loan-to-value (LTV) ratio in October, leading to a slight increase in transaction activity in late 2024. However, uncertainties related to the US presidential election tempered this recovery.

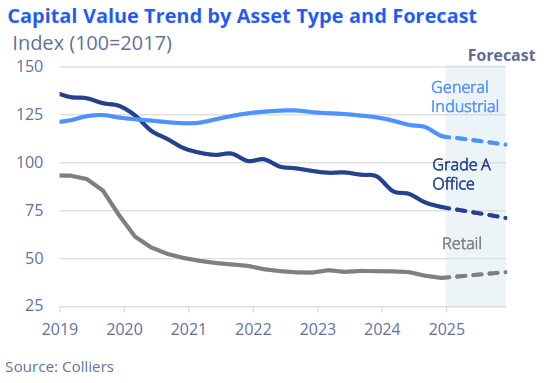

Capital values across major commercial sectors declined in 2024, with Grade A offices dropping 17 percent and high street shops falling 8 percent. Nevertheless, there was an uptick in client inquiries, indicating potential for future transactions as more high-value properties entered the market.

This year, we expect significant challenges to persist. Grade A office rents are projected to decline by 8 to 10 percent, with an expected 3.5 million square feet of new office supply. Retail will remain polarised, with prime locations seeing increased demand and rent under pressure in secondary locations.

The Fed’s rate cuts have slowed under the new administration, potentially delaying market recovery. However, in October 2024, Hong Kong’s “New Capital Investment Entrant Scheme” (New CIES) was expanded to include residential property purchases valued at more than HK$ 50 million as part of the HK$ 30 million investment, with up to HK$ 10 million of the property’s value allowed to be counted towards the requirement.

The 2025 Colliers Global Investor Outlook findings show that in the first half of 2025, institutional and property funds will likely explore lucratively priced markets like Hong Kong and mainland China for value-driven investment opportunities.

Distress Accelerates, Putting High-Value Assets in Play

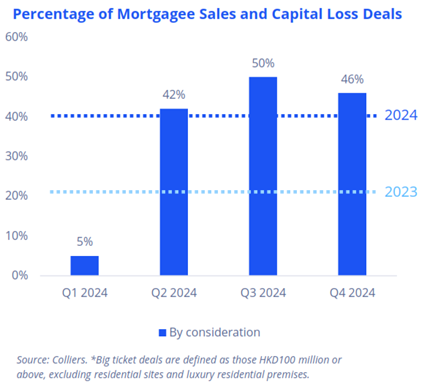

Until recently, we’ve seen relatively little evidence of distressed sales rising across the APAC region, but things are picking up. Hong Kong is the most affected market, as high debt levels and falling property prices have created significant pressure. Foreclosures have increased noticeably. Colliers’ research shows mortgagee transactions involving capital losses made up 46 percent of transactions in Q4 2024, compared to 23 percent in 2023.

However, banks remain cautious and unwilling to take significant loan losses. As declining interest rates erode bid/ask spreads, regional banks are pushing owners to re-evaluate properties, lowering LTV, increasing the cost of capital, and asking for top-up equity. Some banks are unwilling to refinance, leading investors to seek alternative financing and creating opportunities for credit funds. The overall impact is that owners now have more incentive to reduce asking prices because they may not have the extra capital to commit or don’t want to pay more equity.

Hong Kong is the market with the most significant negative carry in the region. On the other hand, Australia, which offers attractive yields, has seen most transactions focused on older office buildings. South Korea’s trouble seems more specific to logistics properties laden with new supply.

Wide bid/ask spreads have slowed sales of traditional core assets. Investors are deploying capital in Japan due to low interest rates and in Australia as cap rates move out. Value-add and opportunistic strategies are in focus. SEA investors are actively enquiring and rerouting funds to take advantage of prime-asset foreclosure sales.

Given high borrowing costs, investors in Hong Kong target properties with 5 to 6.5 percent yields. High-quality assets in prime locations are more affordable, with some deals closing at cap rates as low as 3 to 4 percent.

Accommodation Investment

We anticipate a 17 percent YoY increase in 2025’s investment volume to HKD 40 billion, with cash-rich end-users and some Southeast Asia investors remaining the primary buyers. Debt-laden investors may face challenges, leading to an increased funding gap and more mortgagee sales coming to the market. We expect the percentage of mortgagee sales and capital loss deals in 2025 to range between 40 to 50 percent.

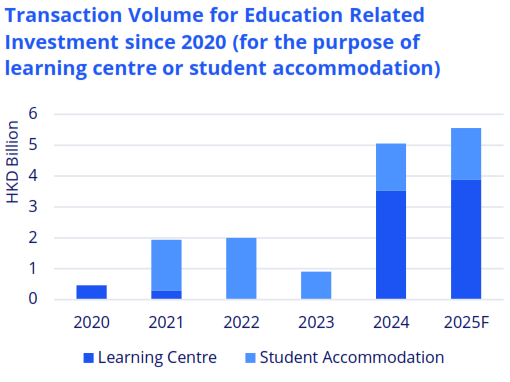

Hong Kong faces a significant accommodation deficit exacerbated by:

- An influx of immigrants through various special work visas

- The government’s plan to make Hong Kong a global educational hub, accepting droves of university students across the spectrum.

Thus, despite the usual assets remaining unappealing, luxury residential is seeing an increase in volume.

There’s strong demand coming from post-secondary educational institutions and high-net-worth investors. Buyers are becoming more active – negotiating for a better price and making more offers on education-related properties. However, managers of sizable funds are still cautious, awaiting more evidence of a market turnaround with more manageable, cheaper financing.

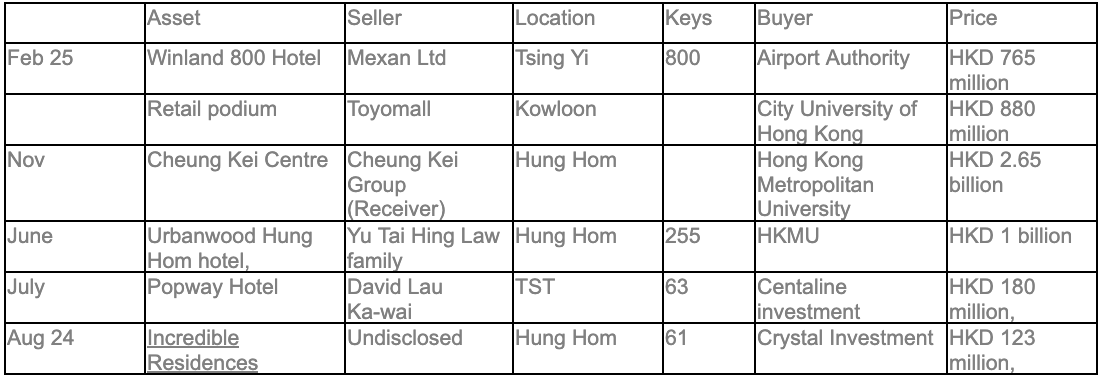

Notable Deals

Recent transactions include the sale of Winland 800 Hotel in Tsing Yi for HK$ 765 million to the Airport Authority and the retail podium in Kowloon sold by Toyomall to the City University of Hong Kong for HK$ 880 million.

Strategic Opportunities

Given that the market strongly favours buyers, we recommend investors seize this opportunity to reposition or acquire commercial properties for use in the education sector. Commercial buildings are in demand by academic institutions, who generally prefer longer leases. The second option is investing in hospitality assets to convert them to student accommodation, which will continue to be in high demand.

Find out more, download the full Colliers 2025 Market Outlook report here.

Leave a Reply