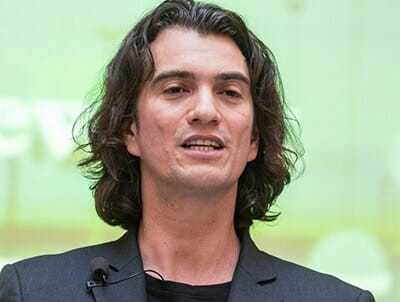

WeWork has proven to be a game-changing business – at least for deposed CEO Adam Neumann.

WeWork has proven to be a game-changing business – at least for deposed CEO Adam Neumann.

Under the terms of a bailout package put together by Softbank, the WeWork founder will be receiving around $1.7 billion in compensation in return for surrendering his hold on the office sharing company that he made into one of the century’s biggest IPO flops, according to an account in the Wall Street Journal.

In total, The Japanese venture capital firm is agreeing to commit another $8 billion in debt and equity into WeWork in return for Neumann turning over control of the co-working pioneer, which is said to be in danger of running out of cash next month if it fails to receive fresh funding.

Bailout Package Values WeWork at $7 Bil

WeWork’s board on Tuesday accepted a bailout package that would including Softbank buying $3 billion in shares from existing investors in the company, including Neumann, while agreeing to move forward an already planned investment of $1.5 billion by Softbank’s Vision Fund which had originally been scheduled for 2020.

Neumann reportedly sees his payout as validation of his accomplishments

In addition to the accelerated timetable for its equity investment, Softbank is also agreeing to loan $5 billion to the New York-based office sharing startup.

The deal values WeWork at $7 billion, according to an account in the New York Times, after the company had hoped earlier this year to be selling shares at a 2019 IPO that would have valued the serviced office provider at over $50 billion.

Upon completion of the buyout, Masayoshi Son’s Softbank would own around 80 percent of WeWork, up from its current holding of around 30 percent.

WeWork’s directors had been also considering a reported $5 billion all debt financing package from JP Morgan, although that offer was dependent on the bank, which would not have loaned the funds from its own balance sheet, attracting third party lenders to the deal.

Softbank Equity Investment Rises to $13 Bil

The bailout program will help to rescue the prospects for a company which Softbank has invested more than $9 billion into so far, according to analysts at Sanford C Bernstein & Co as cited in the Wall Street Journal, and bring the Tokyo-based firm’s total equity investment into WeWork up to $13 billion.

Following the agreement with Softbank, WeWork is expected to begin laying off thousands of staff from a team that numbered 12,500 people at the end of June. Despite the current cash crunch, WeWork has delayed the layoffs up to now, according to a separate Journal account, as it lacks the available funds to provide severance pay.

After dumping Neumann as CEO in September – one week after the IPO attempt was scrubbed for lack of investor interest – WeWork installed company veterans as Artie Minson and Sebastian Gunningham as co-CEOs in September. Since that time the company has put Neumann’s $60 million jet up for sale and begun cancelling side projects such as an elementary school led by the former CEO’s wife, and WeWork’s former Chief Branding Officer, Rebekah Neumann.

Neumann Gets $1.7 Bil Parachute

Central to Softbank’s buyout is Neumann giving up his title as non-executive chairman of WeWork and his control over the company. Following the transaction, the entrepreneur is expected to retain less than a 10 percent holding in the company he co-founded in 2010. The deal also involves Neumann surrendering the 10 times voting rights associated with his shares, with all WeWork stock to carry equal weight in decision-making after the buyout.

In return for allowing Softbank to pull WeWork out of its death spiral, Neumann wins the right to sell $970 million of his shares in the company – around one third of his stake – under the Softbank tender offer, according to the Journal account.

In a step called critical to the deal, the venture capital firm would also offer $500 million in credit to Neumann, who had previously taken out more than $700 million from WeWork, with much of that said to be loans arranged by JP Morgan and secured by his stock in the company he founded. Neumann, would also receive a $185 million consulting fee for his ongoing support to the company, which lost around $2 billion last year.

Softbank executive Marcelo Claure is expected to replace Neumann as chairman of WeWork following the deal, and to begin a search for fresh leadership to replace co-CEOs Minson and Gunningham.

Softbank’s Son is said to have apologised to investors in his Vision Fund this week for the WeWork investment, blaming the debacle on his belief in Neumann, according to the Journal account.

Leave a Reply