The latest Kai Tak plot was sold for a record HK$12.6b

Hong Kong’s Lands Department on Tuesday announced that a consortium of six developers had won the third-largest residential plot on what had been the runway of Hong Kong’s former Kai Tak airport for a record HK$12.6 billion ($1.6 billion).

The winning bidders paid the equivalent of HK$19,636 per square foot for the harbour-view site or 10.46 percent higher than the previous price record set at the former airport site last May by Sun Hung Kai Properties.

The sale, which was announced just a few days after Hong Kong’s developers achieved their biggest sales weekend in six years, is seen by many as a resurrection of developer confidence as the city’s housing market returns to full throttle.

All Star Team Takes Third Kai Tak Plot

Henderson’s Lee Shau Kee has had a hand in three Kai Tak land buys in the last year

According to the Lands Department’s statement, Marble Edge Investments Limited, a consortium comprised of top Hong Kong players Henderson Land Development, New World Development, Wheelock and Company and Chinachem Group, along with Empire Development — a company controlled by the family of the late Walter Kwok — and state-backed mainland developer China Overseas Land & Investment Limited, was awarded the 9,765 square metre residential plot, labelled as Kai Tak Area 4B Site 1 following the tender process.

The plot, located on land jutting out into Victoria Harbour on what was the former airport runway, can yield up to a maximum gross floor area of 59,566 square metres of housing, which is expected to sell for at least HK$30,000 per square foot, after allowing for construction costs of HK$5,000 per square foot and a 20 percent profit margin for the developer.

Of the six members in the marble edge consortium, three of them — Henderson, Wheelock and New World — have now been among the winning bidders in two previous consortium acquisitions on the former airport site within the last year, while another pair of developers joined two of the three joint venture buys.

Wheelock, Henderson and New World had teamed up with China Overseas Land in March this year to win a 9,583 square meter (103,150 square foot) residential plot on the former Kai Tak runway at a price equivalent to HK$13,701 per square foot of finished housing.

That sale was proceeded by the November acquisition of another Kai Tak site by Henderson Land, New World Development and Wheelock, in which they were joined by Empire Group in purchasing a 104,475 square foot residential site on the former Kai Tak runway for HK$8.33 billion.

In addition to those group buys, Marble Edge consortium member China Overseas Land in December last year made a solo acquisition on the former runway, when it paid HK$8.03 billion for a 97,393 square foot residential parcel.

Kai Tak Sales as Market Metrics

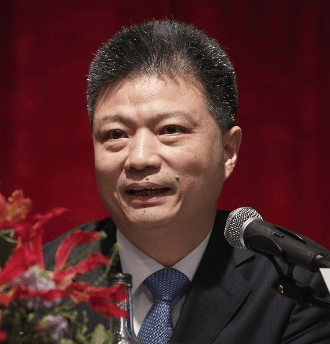

COLI boss Yan Jiangguo picked up Kai Tak’s cheapest plot in December last year

While COLI’s December buy, when buyers were suffering nightmares of trade wars and rate hikes came at HK$13,523 per square foot and marked the low point of Hong Kong’s most recent property correction, another single player purchase shows the previous peak.

SHK’s HK$25.16 billion purchase of a 178,000 square foot residential site in May 2018 works out to a price of HK$17,360 — a high point that was not surpassed until this week’s HK$19,636 purchase.

Hong Kong’s property market has witnessed a stronger-than-expected recovery in the last two months, as the US federal reserve backs away from the idea of future interest rate hikes, which means Hong Kong mortgage holders should also be spared any upswings in bank rates.

After housing prices in city shifted towards a correction since August last year, the market is now showing signs of recovery, with Marble Edge consortium member Wheelock having sold 500 flats at its Montara project in the New Territories over the weekend, setting a two-day sales record for the blue-chip developer of more than HK$4 billion in sales contracts.

Analysts are also predicting an upswing, with Moody’s Investors Service this month forecasting that Hong Kong’s home prices will rise from 8 to 10 percent over the next 12 to 18 months — a reversal of its earlier prediction of a decline of up to 15 percent.

Leave a Reply