Global capital raised for non-listed real estate in 2023 was the lowest since 2016

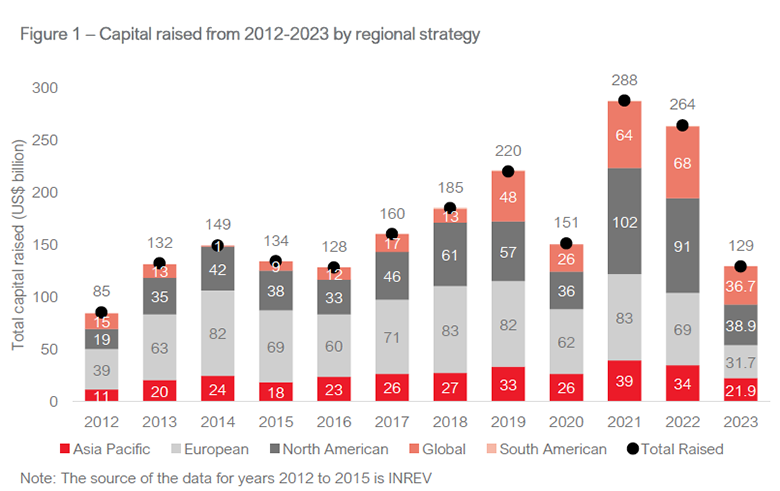

Global investment managers raised some $129 billion of new capital for non-listed real estate in 2023, representing a 51 percent decline from the previous year and the lowest level since 2016, according to the results of a survey published on Wednesday.

The poll of 83 respondents from 19 countries across Asia Pacific, Europe and North America revealed respective year-on-year declines of 55 percent, 41 percent and 62 percent in new capital raised by managers domiciled in those regions, as high interest rates and economic uncertainty weighed on investor sentiment, according to the 2024 Capital Raising Survey published by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV).

“This year’s Capital Raising Survey reflects a challenged year in capital raising. Real estate investments have been challenged by market conditions that have deteriorated and by the high interest rate environment across the globe which has also favoured debt investments globally,” said Amélie Delaunay, ANREV’s senior director of research and professional standards.

The survey also showed that managers deployed just 16 percent of new capital raised last year, down from 26 percent in 2022 and 47 percent in 2021 and marking a record low rate of execution.

The annual poll is a collaboration between ANREV, its European counterpart INREV and US-based non-profit data provider National Council of Real Estate Investment Fiduciaries (NCREIF), which together serve the property investor community.

Riskier Strategies Preferred in Asia

Asia Pacific accounted for 34 percent of last year’s new capital raised by investor domicile, mirroring the region’s 35 percent share in 2022. Europe took the largest share with 38 percent, while North America-domiciled investors accounted for 28 percent of new fund raising.

On an investment destination basis, Asia Pacific represented 17 percent of last year’s new capital raisings, an increase of four percentage points from the previous year. Despite the increase, Asia Pacific saw the lowest regional allocation last year, with North America, global and Europe accounting for 30 percent, 28 percent and 25 percent of capital raised, respectively.

With interest rates remaining elevated, investors backing Asia Pacific-targeted funds favoured higher yield, with opportunistic funds and value-added funds attracting 41 percent and 33 percent of new capital raised, respectively, while lower yield core funds accounted for 26 percent share.

71 percent and 64 percent of total capital raised for Asia Pacific non-listed funds last year was allocated to single country and single sector strategies respectively.

Debt Products Increasingly Popular

The top ten managers accounted for 73 percent of new capital raised last year, while 37 player raised less than $1 billion each.

By investor type, pension funds, insurance companies and sovereign funds accounted for 29 percent, 17 percent and 12 percent of respondents respectively. Other investors including government institutions, family offices and high net worth individuals, foundations, fund of funds and non-profit organisations made up the remaining 42 percent.

Commingled funds and private the preferred investment vehicle for Asia Pacific investors surveyed with 39 percent of capital raised falling under this structure, followed by joint ventures and club deals with 34 percent of capital raised. Separate accounts investing directly into real estate and non-listed debt products rounded out the respondents’ allocation with 19 percent and 8 percent of capital raised, respectively.

Among all investors surveyed, non-listed debt products accounted for 24 percent of the total capital raised, reflecting the attractiveness of the asset class in a high interest rate environment.

Leave a Reply