Catherine Chen of Cushman & Wakefield

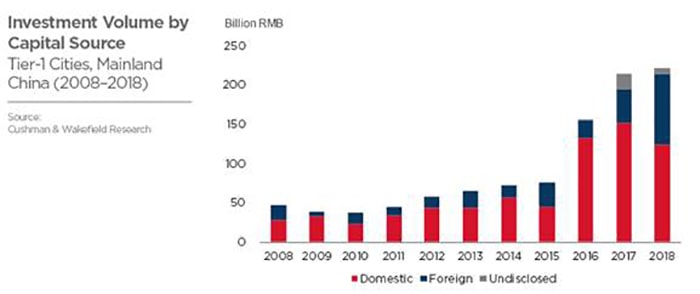

Commercial real estate investment in mainland China reached a record RMB 463 billion ($68.5 billion) in 2018, although growth compared to the previous year slowed to just 9.5 percent.

The year on year rate of increase was close to four times slower than the 40 percent expansion recorded in 2017 compared to 2016, according to a report published this week by Cushman & Wakefield.

Foreign Players Keep Growth Going

Key to this year’s uptick was a renewed activity by foreign investors, as local participation waned due to a tougher lending environment and stricter real estate regulations.

“Prevailing trade frictions and ongoing economic cooling did little to quench foreign investors’ appetite for property in mainland China,” Catherine Chen, head of forecasting and capital markets research for Greater China at Cushman & Wakefield said in a statement. “In 2018, RMB 96 billion worth of investment was led by foreign investors, a 32 percent share of major transactions. The U.S.-originated component of this totaled RMB14 billion (approx. US$2.1 billion).”

Tier-one cities, including Shanghai, Beijing, Guangzhou and Shenzhen, were the primary targets for foreign investors last year with institutions and individuals putting RMB 94.6 billion into the mainland metropolii last year. In all foreign investors accounted for 45 percent of investment in commercial real estate in China’s largest cities during 2018, up from 25 percent of total investment in 2017..

Shanghai Still the Top Target for International Investors

Shanghai was the biggest magnet for foreign capital, attracting RMB 71.5 billion last year, or 61 percent of the city’s total. Foreign investors were especially active in the city during the last final stretch of the year, contributing 76.1 percent of total investment in the fourth quarter, according to Cushman & Wakefield.

Foreign investors were key to maintaining investment growth in China’s largest real estate markets

GIC and Capitaland’s acquisition of the Star Harbour Centre in the city’s Hongkou district for RMB 19.78 billion, the biggest deal in Shanghai this year, helped lead the surge of foreign investment in China’s commercial capital.

Despite a 78 percent year-on-year rise in foreign investment, overall growth in the mainland’s largest metropolitan market for commercial real estate remained lackluster, expanding just 1.6 percent from 2017 to 2018 to RMB 117.2 billion (distributed across 22 deals). The fourth quarter saw overall investment drop 10.8 percent year-on-year to RMB 45.18 billion.

Foreign Capital Picks Favourite Cities

Foreign money accounted for approximately 30 percent of Beijing’s commercial real estate investment, up from two percent a year ago. This 1400 percent spike in activity from overseas pushed Beijing’s commercial real estate investment value to RMB 56 billion for the year, a 26 percent expansion from 2017.

The last quarter accounted for 62.5 percent of Beijing’s yearly total, driven by Gaw Capital’s RMB 10.5 billion sale of Pacific Century Place to a fund affiliated with mainland real estate agency Lianjia.

Commercial real estate investment in Guangzhou climbed 25 percent year-on-year to RMB 27.3 billion, where foreign entities accounted for a fifth of total real estate investment. According to Cushman & Wakefield, the city’s property market, while also constrained by tighter lending, benefited from the government’s Greater Bay Area initiative, which seeks to improve connectivity between Hong Kong, Macau, Guangzhou, and Shenzhen.

Real estate in neighboring Shenzhen, where mainland players still account for 98 percent of investment, did not fare as well. Turnover in the tech hub’s commercial property investment market plunged 26 percent year-on-year to RMB 25 billion, according to the agency’s figures.

The credit squeeze has also pushed investors outside of the city centres. Capital commitments to assets in decentralized locations accounted for 79 percent of the total in Shanghai last year, up from 11 percent in 2017. This tendency was especially strong in the office and mixed use sectors. A similar trend was observed in Guangzhou, where these emerging areas accounted for 75.6 percent of all deals, up 19 percentage points from last year.

Leave a Reply