Average office vacancy across Tokyo dropped to 5.47 percent in the first quarter

Japan’s thriving office market leads Mingtiandi’s headline roundup today as vacancy in top buildings falls to under 5.5 percent. Also in the news, China’s Wanda agrees to sell its UK yacht unit and S&P slashes Vanke’s credit rating to junk.

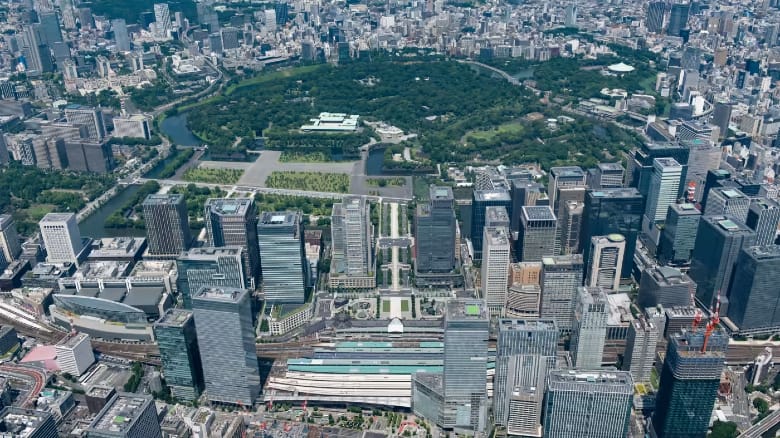

Tokyo Office Vacancies Hit Three-Year Low, Bucking Global Slump

Tokyo office vacancies dropped to a three-year low in March, a sign that the commercial real estate market in the Japanese capital is withstanding the slump afflicting major cities around the world.

The rate in Tokyo’s five central business areas fell to 5.47 percent, the lowest since March 2021, according to real estate broker Miki Shoji, which compiles one of the most-watched measures of commercial office use in the city. Rents have also ticked up after falling through most of 2023 — rising every month so far this year for existing buildings. Read more>>

Wanda Agrees to Sell James Bond’s Yachtmaker Sunseeker to Lionheart

An entity affiliated with Dalian Wanda Group agreed to sell Sunseeker International, a maker of yachts, to Lionheart Capital, according to people with knowledge of the matter.

The Chinese conglomerate and Miami-based Lionheart have signed a so-called sale and purchase agreement, said one of the people, all of whom asked not to be identified discussing confidential information. The transaction, which is subject to British regulatory approval, is poised to close as soon as next month, one of the people said. Read more>>

S&P Slashes Property Giant China Vanke’s Credit Rating to Junk

There was more bad news for the battered Chinese property sector on Wednesday, as S&P Global became the last of the major credit rating firms to strip China Vanke of its investment-grade status.

S&P slashed the rating of China’s second-biggest developer by sales by a hefty three notches, from BBB+ to BB+, leaving it one rung into junk territory. Read more>>

China Says Economy ‘Stable’, Rejects Fitch Downgrade of Fiscal Outlook

China’s Finance Ministry denounced a report by Fitch Ratings that kept its sovereign debt rated at A+ but downgraded its outlook to negative, saying Wednesday that China’s deficit is at a moderate and reasonable level and risks are under control.

Risks to China’s public finances are rising, Fitch said, as Beijing works to resolve mounting local and regional government debts and to shift away from heavy reliance on its troubled property industry to drive economic growth. Read more>>

KKR Aims to Reach $1T in Assets Within Five Years

KKR laid out a plan to scale its core businesses as it aims to reach at least $1 trillion in assets under management in five years.

The firm intends to build on its existing asset management, insurance and strategic holdings units to reach that milestone, it said in an investor presentation Wednesday ahead of its investor day in New York. KKR also seeks to generate annual adjusted net income of more than $15 a share within a decade. Read more>>

Chinese Cities Further Ease Homebuying Policies to Spur Sales

China’s local governments are stepping up the easing of rules for their housing markets, as a protracted sales slump weighs on the economy and developers.

A total of 15 cities had removed the lower limit for mortgage rates on first-home purchases as of Wednesday, the Economic Observer reported, citing its tally of announcements by local governments. The move, powered by the central bank’s relaxation of minimum mortgage rates last year, is designed to entice homebuyers as prices fall. Read more>>

Former WeWork Exec Shampine Gives Up on Korean Brokerage Platform

DNK, established by former WeWork Korea General Manager Matthew Shampine, recently ceased its real estate brokerage platform service Dongnae, to focus on its property management software system known as DNK, targeting the Asia Pacific region, the company said Thursday.

Shampine, better known as the husband of actor Kim Soo-hyun, who played Claudia Kim in the Marvel movie series, established the proptech startup in 2020 and launched Dongnae the following year. But the CEO said Saturday that the company decided to stop offering the brokerage service. Read more>>

ADB Says Developing Asia Set for Growth as China’s Economy Slows

Much of developing Asia outside of China is poised for expansion in the next two years as consumer demand remains strong and inflation eases, according to the Asian Development Bank.

The region’s economy is set to grow at a 4.9 percent pace this year and in 2025, according to the group’s annual outlook. Inflation is seen easing slightly to 3.2 percent this year and 3 percent in 2025 from an estimated 3.3 percent last year. Growth is set to slow in China, though, as the real estate sector and domestic demand remain weak, according to the report. Read more>>

Tune in again soon for more real estate news and be sure to follow @Mingtiandi on X, or bookmark Mingtiandi’s LinkedIn page for headlines as they happen.

Leave a Reply