McKinsey and Company, along with China Minsheng Bank recently released a study of the investment preferences of Chinese high net worth individuals, and results contradict much of the conventional wisdom regarding China’s wealthy.

McKinsey and Company, along with China Minsheng Bank recently released a study of the investment preferences of Chinese high net worth individuals, and results contradict much of the conventional wisdom regarding China’s wealthy.

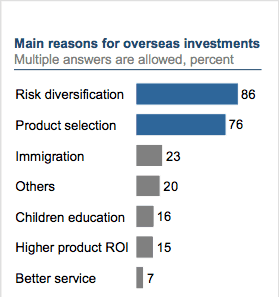

While an industry has sprung up around offering immigration services and promises of passports to China’s elite, the McKinsey report found that 86 percent of the respondents to their survey cited diversification of financial risk as a reason for investing overseas. By contrast, only 23 percent cited a desire to immigrate and 16 percent listed their children’s education as a reason for listing overseas.

The number of China’s high net worth individuals – defined as someone with more than $1 million to invest – increased 15 percent annually from 2010 to 2012, according to McKinsey’s estimates. The report foresees the number of this rich folks as rising 19 percent annually from now through 2015, which would create a cadre of 1.9 million red investors by that time.

Around 60 per cent of China’s rich own overseas investments, according to the report, and these investments total an estimated 10 percent of the group’s assets.

The report was based on interviews with 700 high net-worth individuals in 29 Chinese cities, including face-to-face interview with 100 of those individuals.

Disappointingly for the brokers hoping to sell more apartments in Vancouver, London and Melbourne, the report predicts that private equity products should overtake real estate as the most popular place to park the assets of this rich class in the next five years. However, at this time, property still accounts for 31 percent of the invested wealth of China’s elite, according to the report, with basic banking products being the next most popular investment accounting for 26 percent of their assets.

Perhaps as big of a reason as any for Chinese to look overseas for investment opportunities is simply the slowing pace of the Chinese economy, together with the deceleration of the Renminbi’s appreciation versus global currencies.

You can read a summary of the report findings here.

Leave a Reply