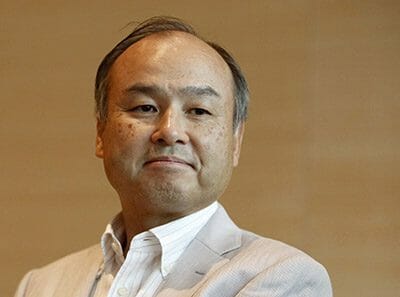

SoftBank CEO Masayoshi Son decided to invest another $3 billion into WeWork

American flexible working space provider WeWork on Tuesday announced that its largest shareholder, SoftBank, has committed another $3 billion to the company, boosting its valuation to at least $42 billion.

Softbank is investing in WeWork through a warrant that allows the venture funding titan run by Japan’s Masayoshi Son to buy WeWork shares at a price of $110 or higher before September 2019, according to media accounts, and values the shared real estate startup at more than double its 2017 valuation of $20 billion.

The new funding from Softbank pushes WeWork’s warchest of cash and cash commitments to $6.5 billion, according to an account in the Financial Times, citing a presentation by WeWork to investors.

WeWork’s cash, and the confidence that comes with it, is already evident in Asia, where the company has revealed plans for three new mainland Chinese locations in the last month, with still more centres opening in Southeast Asia and India.

Faster Growth and Greater Revenues

As part of the announcement on Tuesday, WeWork highlighted the progress that it has made in building a global presence.

The co-working pioneer now has 297,000 desks in place across 24 countries, the New York Times cited company representatives as saying, with plans to extend that by another 100,000 desks by the end of this quarter — expanding its available stock as much in the current three months as it did during all of 2017.

And those available seats are helping it bring in more cash, with third quarter revenues doubling from $241.1 million in 2017 to $482.3 million during the most recent three months. For the first nine months of 2018, WeWork says it has taken in $1.25 billion in revenue, and it expects to bring in more than $2 billion in sales for the full calendar year.

Building Out an Asian Operation

Much of WeWork’s expansion has been happening in Asia, where it is rolling out multiple centres this quarter in mainland China, India and Southeast Asia.

Last month the company held a signing ceremony for a new centre in Hangzhou in eastern China’s Zhejiang province, and also signed a lease for a 9,000 square metre space in the Damazhan Commercial Centre in Guangzhou. Company sources have also told Mingtiandi that WeWork will open a new centre in the Hubei provincial capital of Wuhan within the next three months.

Earlier this month, WeWork announced the opening of three more centres in Singapore, which will give it 2,500 more desks in Southeast Asia’s largest financial hub. Elsewhere in the Southeast Asian region, the company last week announced plans to open its first centres in the Philippines and Vietnam.

In India, WeWork was reported late last month to have leased 500,000 square feet of new space in the Mumbai metropolitan area, as well as in Bangalore, as it builds out its presences on the sub-continent.

Cash Needed to Fuel Expansion

WeWork CEO Adam Neumann is ready to receive more cash from his partners at Softbank

The fresh cash from Softbank may come in handy for WeWork, which also revealed this week that it had lost $1.22 billion during the first nine months of this year, according to the New York Times account.

And the pace of those losses may be quickening, with the company declaring that it lost an average of $162.33 million per month in the third quarter to reach a net loss of $487 million for the three month period. During the first half of the year it lost a total of $723 million, or a pace of $120.5 million in losses each month.

During the full year of 2017 WeWork had said that it lost $933 million, or $77.5 million per month. Despite these financial challenges, this latest investment from Softbank, which could value WeWork at around $45 billion by some estimates, makes the company the second most valuable startup in the US, behind only Uber.

SoftBank Brings WeWork Commitment to $6 Bil

According to SoftBank, this latest $3 billion commitment comes from SoftBank’s own balance sheet rather than from the firm’s Vision Fund, which last year invested $4.4 billion in the now eight-year-old company.

Vision Fund, which sources nearly half of its cash from Saudi Arabia, has become a controversial source of funding following the murder of journalist Jamal Khashoggi by Saudi agents.

In total, Vision Fund committed just under $5 billion to the flexible office provider’s Asia expansion through a pair of deals earlier this year and in late 2017. In August of this year, Softbank added a $1 billion convertible note deal with WeWork, to bring its equity commitment to the company to $6 billion.

Leave a Reply