CPPIB head Mark Machin

The Canada Pension Plan Investment Board (CPPIB), one of the world’s biggest pension schemes, said the trade tensions between the United States and China could open up opportunities for the national pension fund manager to acquire Chinese assets at knock-down prices, according to an account by Reuters.

“The thing for us is to be patient and look for good opportunities that are arising as a result of market stress and economic stress,” Machin was cited as saying in the Reuters report. “I think we’ll find very interesting opportunities in China over time as this continues.”

The Toronto-based investment group currently has C$28 billion ($21.2 billion) invested in mainland China, a significant portion of which is allocated through partnerships with real estate developers including industrial specialist Goodman Group and Longfor Properties.

Canadians Shopping for China Bargains

CPPIB, one of the world’s biggest investors in real estate and infrastructure, has said previously it plans to allocate up to 20 percent of its assets to China by 2025, up from the 7.6 percent of its portfolio it currently has invested in the world’s second-biggest economy.

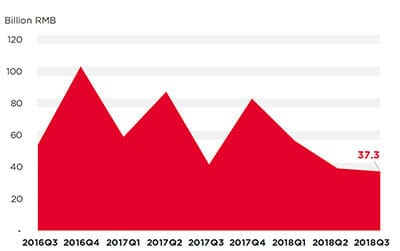

Investments in commercial property in mainland China fell to RMB 37.2 billion last quarter (source: Cushman & Wakefield Research)

“It’s a sensible thing to increase our supply to this market. We are building expertise, and we think valuation is not perfect in this market, so there are opportunities for skilled investors to find really good value,” Machin told China Daily in a recent interview.

The US-China dispute has seen both sides imposing tariffs on billions of dollars worth of the other’s imports, which adds to uncertainty and investor apprehension. Coupled with tighter credit on the mainland the tense political situation has coincided with a general slowdown in commercial real estate investment on the mainland.

Investments in income generating real estate assets in mainland China fell to RMB 37.3 billion in the third quarter of 2018, according to a recent report by Cushman & Wakefield, down from a peak of RMB 100 billion in the fourth quarter of 2016.

Slow Growth in Q2

CPPIB, which manages Canada’s national pension fund and invests on behalf of 20 million Canadians, delivered a net investment return of 0.6 percent during the second quarter of fiscal 2019, as its net assets grew to C$368.3 billion ($279.2 billion) by the end of the period, which closed on September 2oth. Three months earlier the fund’s assets stood at C$366.6 billion.

The slower growth was due in part to the strength of the Canadian dollar, which hit a four-month high in September, according to a statement released by the fund manager on Friday.

“While returns were relatively flat in the second quarter, our teams performed well against our underlying investment strategy,” said chief executive Mark Machin. “Foreign currency exchange-rate declines relative to the Canadian dollar were the Fund’s main headwind during the quarter, offsetting strong local currency performance.”

Machin added that during times of increased market volatility, CPPIB was inclined to take advantage of the fund’s long horizon and pursued diverse and innovative investment approaches.

CPPIB Keeps Up China Deal Pace

CPPIB recently stepped up its Chinese logistics bets with Goodman Group

In August, it committed an additional $1.75 billion of equity with the ASX-listed Goodman Group to the Goodman China Logistics Partnership on an 80:20 basis to step up the pace of its logistics bets as more capital rushes to meet the needs of the mainland’s growing consumer class.

In July, CPPIB also launched a new investment cooperation with Longfor Group, a Hong Kong-listed Chinese property developer, to develop rental housing programs in China with an initial targeted investment of approximately $817 million.

Its other investments in the country include a stake in Raffles City, a commercial real estate development in Shanghai.

In addition, the fund manager has about $3 billion invested in Chinese equities due to its participation in China’s Qualified Foreign Institutional Investor program, which allows foreign institutional investors to buy securities listed on stock exchanges in Shanghai and Shenzhen, the Financial Times reported.

In May, CPPIB reported an 11.6 percent return on investments in its latest fiscal year but warned that double-digit growth was not sustainable with competition for assets intensifying.

Leave a Reply