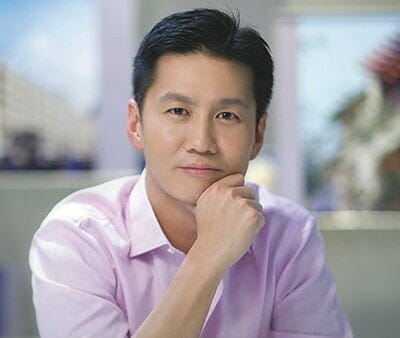

Goodwin Gaw is ramping up his firm’s portfolio in the Bay Area

Gaw Capital Partners is building up its property holdings in California’s Bay Area, with an affiliate of the Hong Kong-based private equity firm paying $93.5 million this month for a Silicon Valley office building.

An investor called GC Orchard Trimble, which shares a Los Angeles address with Gaw Capital and its US affiliate Downtown Properties, acquired the three-building campus in San Jose on June 14th, according to an account in west coast real estate site The Registry. citing sources familiar with the transaction.

The company is associated with the Los Angeles office address of Gaw Capital Management and Gaw’s US affiliate, Downtown Properties, according to an account in local newspaper The Mercury News, which cited county property filings

Gaw paid approximately $467 per square foot to acquire the 218,000 square foot (18,600 square metre) complex at the corner of West Trimble Road and Orchard Parkway in north San Jose from San Francisco-based real estate investment firm DivcoWest, which had purchased the asset at the end of 2012 for $39 million. Divco is said to have renovated the property, which is leased to a US unit of Japanese electronics firm Toshiba, in 2014.

Gaw Capital did not reply to Mingtiandi’s request for comment by the time of publication.

Gaw Moves into Tech-Friendly Neighbourhood

Gaw Capital’s latest win is close to the offices of Google and Apple

The latest deal extends Gaw Capital’s portfolio into a neighbourhood fast becoming fashionable with American tech giants. In 2015, Google leased a pair of adjoining office buildings totalling about 174,000 square feet at 75 E Trimble Road and 2600 North First Street, which are located a block away from the Toshiba office.

And in February this year, Apple snapped up two large pieces of land valued at over $61 million in the area to develop a new campus which would be just 1.3 kilometres south of Gaw Capital’s new purchase.

Gaw has been seeking opportunities to ramp up its portfolio in the Bay Area where, according to its corporate website, it already owns six properties.

Bay Area Deal Comes After Closing of US Fund

In late March, the firm run by Hong Kong’s Gaw family was reported to be in discussions to acquire the 28-storey 123 Mission office building in San Francisco’s SOMA from Chinese conglomerate HNA Group. Gaw ultimately passed on the investment and the property was snapped up by New York City-based Northwood Investors for $290 million earlier this month.

Gaw last month closed its Gaw Capital US Fund III with total commitments reaching a hard cap size of $412 million. The US value-add real estate fund targets real estate opportunities mainly on the west coast, including Southern California, the San Francisco Bay Area and the Pacific Northwest.

The limited partner base of the new fund is about 45 percent US-based and 55 percent international. Among the vehicle’s major participants, the Ohio Bureau of Workers Compensation Fund invested $50 million, while the San Francisco Employees Retirement System injected another $50 million. South Korean institutional investors were also said to have committed $180 million.

Leave a Reply