The disposal of the Daikanyama building will leave SGREIT with one remaining asset in Japan

Singapore-listed Starhill Global REIT has agreed to sell its Daikanyama commercial building in Tokyo to an undisclosed buyer for JPY 1.88 billion ($14 million).

The price represents a 39.1 percent premium to the latest valuation and a 2.9 percent premium to the acquisition price of the three-storey property, the trust’s manager said Friday in a release.

The commercial building is in Ebisu district of Tokyo’s Shibuya special ward, about a three-minute walk from Daikanyama railway station, and has 8,087 square feet (751 square metres) of net lettable area for retail and office use. The freehold property’s three tenants include a design company and a gym.

“We are pleased to announce the divestment of Daikanyama at an attractive premium to both the latest valuation and our original acquisition price,” said Ho Sing, CEO of SGREIT’s manager. “As the investment was largely funded by yen borrowings, there is minimal currency impact despite recent weakness of the Japanese yen against the Singapore dollar.”

Japan Assets Halved

SGREIT acquired the Daikanyama building in 2007 for JPY 1.82 billion. The property was last valued at JPY 1.35 billion, and it accounts for 0.5 percent of the trust’s asset value and 0.4 percent of the portfolio’s net property income.

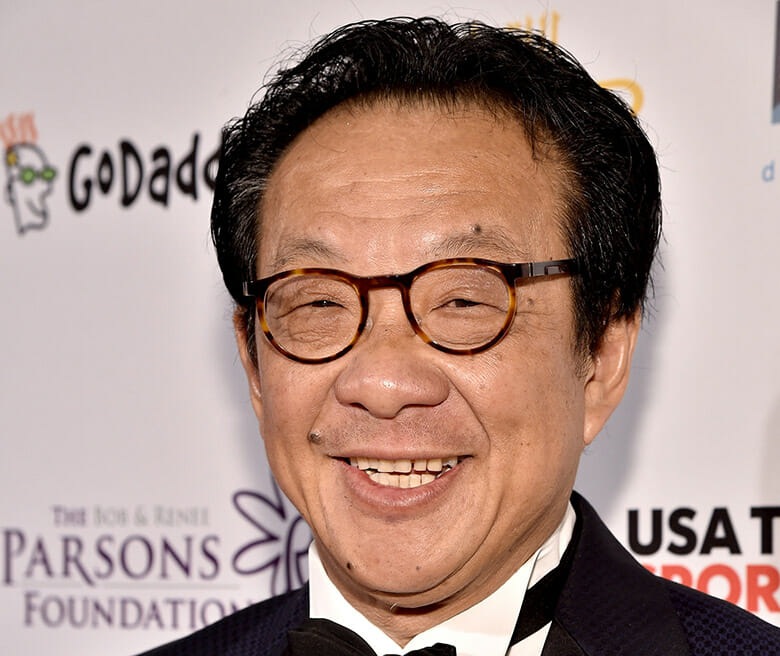

Starhill Global REIT chairman Francis Yeoh (Getty Images)

The transacted price of JPY 1.88 billion works out to JPY 232,472 ($1,731) per square foot of NLA and a yield of 2.77 percent, based on net property income for the financial year ended 30 June 2022.

Upon completion of the divestment in early 2023, SGREIT will be left with a single asset in Japan: the 18,816 square foot Ebisu Fort commercial building, valued at JPY 3.62 billion.

“Regardless of the Tokyo divestments in the past few years, Japan remains one of our key markets of interest and we will continue to explore potential investment opportunities,” Ho said. “This divestment allows us to unlock value, pare down debt and provide us with greater financial flexibility and capacity to focus on new assets that align with our growth strategy.”

Luxury Mall Revamp

Also this week, SGREIT unveiled its revamped Malaysian luxury mall, The Starhill, after a two-year overhaul.

Located in Kuala Lumpur’s Bukit Bintang retail district, The Starhill is connected to two high-end hotels: JW Marriott Hotel Kuala Lumpur and The Ritz Carlton Kuala Lumpur.

The seven-storey, 333,289 square foot mall has a valuation of S$278 million ($207.4 million) and boasts tenants including Louis Vuitton, Tom Ford and Rolex.

Leave a Reply