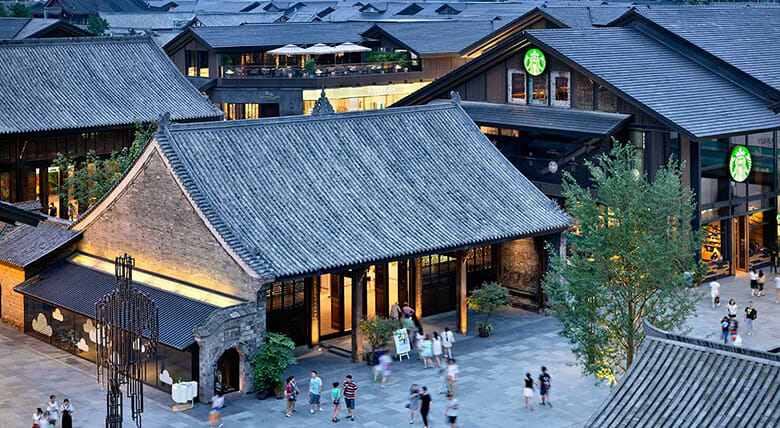

Sino-Ocean Taikoo Li Chengdu opened for business in 2015

Swire Properties is taking full ownership of a Chengdu mall through a deal to buy out Sino-Ocean Group’s interest in the 50:50 joint venture for RMB 5.55 billion ($800 million), as the mainland partner in the development grapples with a liquidity crunch.

Sino-Ocean, which saw its Sino-Ocean Capital unit default on a $20 million bank loan in September and had its credit rating downgraded to junk in recent months, noted in a statement to the Hong Kong exchange that the disposal of its stake in Sino-Ocean Taikoo Li Chengdu would “generate substantial cash inflow to the SOGH Group, thereby replenishing its working capital and will lower the leverage ratio and refine the financial indicators of the SOGH Group”.

Swire, which has been ramping up its mainland investments, including agreeing in December 2020 to expand its Indigo commercial joint venture with Sino-Ocean in Beijing, said Thursday in a filing with the Hong Kong stock exchange that the Chengdu acquisition “is expected to make immediate income contribution to Swire Properties and create long-term value for Swire Properties and its shareholders”.

Sino-Ocean Taikoo Li Chengdu is a retail-led project in Sichuan province’s capital and consists of a low-rise, lane-driven concept mall and a boutique hotel with 100 rooms and 42 serviced apartments managed by Swire Hotels. Located next to Chengdu’s ancient Daci Temple in Jinjiang district, the development has a gross floor area of 1.6 million square feet (148,645 square metres).

Different Directions

Beijing-based Sino-Ocean is selling its half-stake in the project to Swire via a series of three transactions between now and the end of next April, Swire said.

Opened in 2015, the project is undergoing a strategic upgrade with respect to its mix of luxury brands and is expected to make an immediate income contribution and create long-term value for Swire Properties and majority shareholder Swire Pacific, according to Thursday’s filing.

Swire Properties chief executive Tim Blackburn

Swire’s takeover of Sino-Ocean Taikoo Li Chengdu, which values the asset at RMB 6,938 ($1,000) per square foot of GFA, comes as the Hong Kong-based builder continues to expand its presence in mainland China at a time when other offshore investors are treading gently amid the nation’s property crisis and COVID-19 woes.

Swire Properties CEO Tim Blackburn took the opportunity of a September visit to Shanghai to sign a letter of intent with the government-owned Lujiazui Group to develop a 6.5 million square foot mixed-use project in the megacity’s Qiantan area. Blackburn also broke ground on Swire’s second luxury retail project in Guangzhou and pushed forward the builder’s Taikoo Li mall project in Xi’an during his mainland trip.

Sino-Ocean, meanwhile, is beating a retreat as a liquidity crisis compels the builder to offload assets to help meet its debt obligations. The group in October revealed plans to sell its entire 10 percent stake in the China Life Financial Centre office tower in Beijing for RMB 230 million ($31.8 million) to China Life, which holds a 30 percent stake in Sino-Ocean.

A month before that announcement, Sino-Ocean Capital Holding Ltd, a 49 percent-owned subsidiary of the group, defaulted on a $20 million bank loan from Macau-based Luso International Banking Ltd. The subsidiary also delayed payment for a RMB 1 billion domestic bond puttable in September.

Righting the Ship

Sino-Ocean’s cash crunch caused ratings agency Fitch to cut its long-term foreign currency issuer rating for the developer to BB from BB+ in September, ranking it one notch further down into junk territory. Moody’s had downgraded Sino-Ocean in August, with Fitch forecasting a 21 percent decline in Sino-Ocean’s contracted sales for the full year of 2022.

With its property unit under pressure, China Life has been injecting liquidity into Sino-Ocean over the past few months. In July, the insurer provided an RMB 4 billion loan to Sino-Ocean, with the developer pledging its 50 percent interest in Sino-Ocean Taikoo Li Chengdu as collateral.

The disposal of its stake in the Chengdu project will let Sino-Ocean refine the structure of its assets, accelerate its return on investment in the property and generate cash flow to replenish working capital and lower its leverage ratio, the group said Thursday in a filing with the Hong Kong stock exchange.

Sino-Ocean expects to realise a net gain of RMB 1.39 billion ($200 million) upon completion of the transactions with Swire, according to the filing.

Leave a Reply