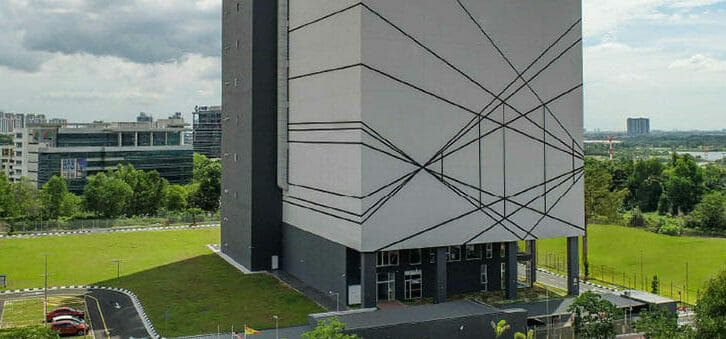

AIMS’ flagship project in Cyberjaya, Malaysia broke ground in 2020 (Source: Uptime Institute)

US real estate investment trust DigitalBridge Group is acquiring a 49 percent interest in AIMS Data Centre from Malaysian telecom firm Time dotCom for RM 2.01 billion ($438 million), with plans to grow the data centre platform in Southeast Asia, the companies announced on Tuesday.

Backed by Malaysia’s sovereign wealth fund Khazanah Nasional Berhad, Time dotCom on Monday entered into a sale and purchase agreement to sell the nearly half-stake in AIMS to funds managed by DigitalBridge in a deal which values the platform at RM 3.2 billion.

Following the transaction, the partners plan to focus on growing the Southeast Asian edge data centre platform, with AIMS already having mapped out expansion into Vietnam.

“AIMS is a leading operator in the region poised for significant growth, with a strong management team, a robust development pipeline and considerable expansion capacity,” DigitalBridge managing director and head of Asia Justin Chang said in a statement. “This is a terrific platform for DigitalBridge, and we are excited to partner with TDC, which has a long heritage of building connectivity-linked businesses across Southeast Asia.”

Rapid Expansion Eyed

The transaction, set to close by the second quarter of 2023, will give DigitalBridge partial ownership of AIMS’ 63-megawatt data centre portfolio which currently includes three locations in Malaysia and another in Bangkok, Thailand, based on the company’s website.

DigitalBridge managing director and head of Asia Justin Chang

The biggest facility currently is AIMS’ flagship location in Cyberjaya that began operations late last year. It has 43,200 square feet in net lettable area and an IT load capacity of up to 50 megawatts. The company also has a 10-megawatt facility in downtown Kuala Lumpur spanning 11,204 square metres of floor space.

According to the website, AIMS also has three upcoming projects in Vietnam, including one in Hanoi and two in Ho Chi Minh City.

The partnership plans to expand the platform’s presence across primary and secondary ASEAN cities to provide rack space for multinational firms, large enterprises, content providers, Internet infrastructure providers and financial institutions.

Time dotCom said bringing in a partner with a deep global presence in the sector is crucial in expanding the platform given the sizable investment involved.

The telco firm’s commander-in-chief Afzal Abdul Rahim said up to RM 1 billion of the sale proceeds will be used to fund special dividends to existing shareholders, and the remaining balance will be reinvested into the group’s operations.

“We believe that DigitalBridge is the right partner as they are committed to building on AIMS’ heritage and capitalise on its strengths,” Afzal said. “We see this as a true partnership that will allow us to tap on their global experience in other markets.”

Post-sale, AIMS will be run by its current management team headquartered in Kuala Lumpur.

DigitalBridge in Asia

After a roughly 8-month contest for a slice of AIMS, DigitalBridge continues to go deeper into the APAC data centre market after it took over the digital infrastructure arm of Hong Kong telecom PCCW through a $750 million deal in July 2021.

The New York Stock Exchange-listed REIT, formerly known as Colony Capital, is said to have bested competitors including Equinix, Digital Edge and ST Telemedia Global Data Centres in a tender which began in March, according to a Bloomberg report at the time.

A Bloomberg report in August indicated that DigitalBridge and Equinix had been shortlisted in the stake tender, with other firms having been involved in the process including BDx, a portfolio company of US private equity firm I Squared Capital; Stonepeak-backed Digital Edge, as well as ST Telemedia Global Data Centres, a Singapore-based operator controlled by Temasek Holdings.

In July last year, DigitalBridge agreed to buy out PCCW DC’s business including nine data centres with 75 megawatts of power across Hong Kong, mainland China and Malaysia at the time of sale. The REIT then two months later merged PCCW DC with its Singapore-based Agile Data Centers unit to consolidate the APAC portfolio under its Vantage Data Centers unit.

Vantage has six locations in APAC, nine facilities in North America and another nine locations across the Europe, Middle East and Africa region.

DigitalBridge, which now has $50 billion in digital infrastructure assets globally, was previously called Colony Capital until a rebranding in June 2021 following the trust’s $2.7 billion sale of its non-tech-related real estate funds business to Softbank-backed Fortress Investment Group.

Leave a Reply