The Hillview Rise site looks ready for digging to begin

A joint venture between Singapore builder Far East Organization and Japan’s Sekisui House emerged as the highest bidder for one of two residential land sales in the Lion City that closed late Thursday. Analysts, however, were quick to point to muted turn-out and restrained tender prices in the pair of auctions as evidence of a more cautious mood among developers.

Auction results from the Urban Redevelopment Authority (URA) showed that a Far East subsidiary, together with Sekisui House, one of the largest homebuilders in Japan, made the top offer of S$320.78 million ($225.6 million) for a 10,395 square metre (111,890 square foot) site on Hillview Rise in Upper Bukit Timah – outbidding tenders submitted by SGX-listed firms UOL Group, City Developments Ltd and Sim Lian Group.

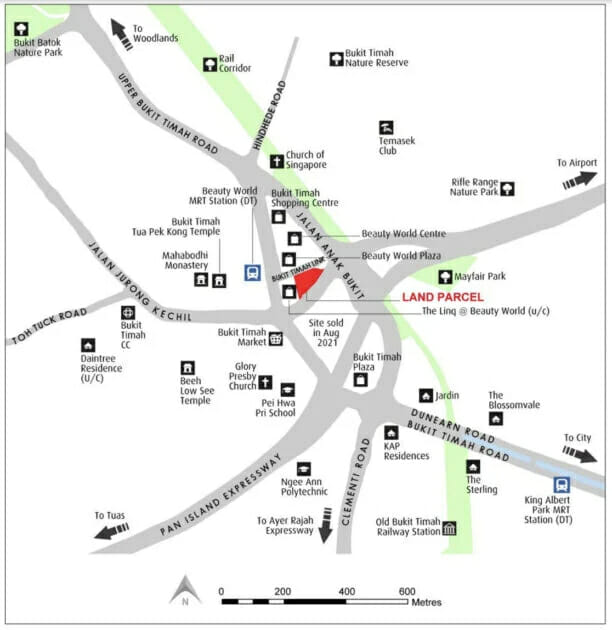

The second site, located between Beauty World Centre and Bukit Timah Plaza, attracted five bids, with local builder Bukit Sembawang Estates making the highest offer for the 4,611 square metre site at S$200 million ($141.3 million). If awarded, the Bukit Timah Link site would be Bukit Sembawang’s first win at a government land sale.

“Developers’ participation in these latest public land tenders was less active than we had expected, particularly for the Bukit Timah Link site,” said Wong Siew Ying, research head at PropNex Realty. “Despite the strong sales performance at recent new launches, the level of participation is indicative of the cautious sentiment amongst developers – who are likely wary of the global headwinds and economic uncertainties going forward, particularly the risk of a global recession in 2023.”

Long-Term Partners Back At It Again

The top bids for the two auctions drew mixed reactions from analysts, as Wong sees the top tenders falling within his agency’s expectations, while Lam Chern Woon, research and consulting head at Edmund Tie, considers the bid prices “fairly restrained.”

Marc Boey of Far East International

Lam said the top bid for the Bukit Timah Link site was in line with earlier predictions, while the rest of the offers were more conservative. For the Hillview Rise site, he said the slim difference between the bids offered “reflected caution among developers in a considerably uncertain climate.”

“Rising interest rates could be perceived to have an impact on affordability and housing demand in the suburban mark,” he added.

The Far East-Sekisui House JV offered to pay S$1,024 per square foot of the Hillview Rise site’s maximum gross floor area of 313,305 square feet, which could yield up to 335 new homes near Hillview MRT station on the Downtown Line. Its offer of S$320.8 million for the 99-year leasehold land was just 1.25 percent higher than the second-highest bid of S$316.8 million from CDL.

“This presents an excellent opportunity for Sekisui House and Far East Organization to create another notable residential property in the Upper Bukit Timah enclave,” said Marc Boey, executive director for property services and chief operating officer at Far East International.

If awarded, the upcoming Hillview Rise project will add to the string of joint developments by the two property heavyweights, which worked together with Frasers Property to build the Watertown and Waterway Point mixed-use complex in Punggol in 2016.

Currently, a Far East-Sekisui House JV, together with Hong Kong’s Sino Group (which like Far East Organization is controlled by Singapore’s Ng family), are developing a 372-unit Reserve Residences in Jalan Anak Bukit with plans to launch the project early next year. That luxury home development is situated within a 10-minute drive of Hillview Rise.

PropNex estimates that homes in the Hillview Rise project will be priced at around S$2,000 per square foot. That rate would reflect a nearly 15 percent premium above the average current selling price of S$1,712 per square foot for Hong Leong’s Midwood project in Hillview Rise.

Banking on Past Success

Bukit Sembawang’s offer for the Bukit Timah Link leasehold site – which is located just 10 minutes drive south from the Hillview Rise plot – is equivalent to S$1,341 per square foot of the project’s maximum GFA of 148,908 square feet.

Bukit Sembawang is set to make its first win in a government land sale

To secure its first-ever win at a government land sale, the SGX-listed developer offered 15.7 percent more than its nearest competitor, a unit of Wing Tai Holdings which bid S$172.9 million for the site.

The five tenders were just half of the 10 offers which PropNex’s Wong expected for the 4,611 square metre site.

Propnex estimates that homes at the Bukit Timah Link project will be priced at around S$2,400 per square foot. Bukit Sembawang’s win came after the developer sold more than three-fourths of its 298-unit Liv @ MB condo in District 15 during its launch weekend in May at an average selling price of S$2,387 per square foot.

Knight Frank Singapore research head Leonard Tay said the development may still see “keen interest” from homebuyers considering its location near the Beauty World MRT Station and the strong sales recorded when BBR Holdings launched the adjacent The Linq@Beauty World project two years ago.

“Although the pool of prospective homebuyers may now be smaller as a result of the clouded economic outlook, the more palatable total of about 160 residential units would mitigate some of the development risks,” Tay added.

URA data showed private home prices in the city-state went up 3.8 percent in the third quarter from the previous three months – rising for the 10th consecutive quarter despite the government imposing two sets of property cooling measures in a span of nine months.

Note: an earlier version of this story misspelled Far East Organization as Far East Organisation, omitted Marc Boey’s title as chief operating officer of Far East International and misidentified the locations of The Reserve Residences as Tampines, instead of Jalan Anak Bukit. Mingtiandi regrets the errors.

Leave a Reply