Stuart Jackson, CEO of InfraRed NF

Two major buyouts have been announced in Asia’s self-storage industry in the past two weeks involving cash of more than $50 million, as the niche investment sector grows in popularity with the region’s property investors.

Private equity firm InfraRed NF announced its acquisition of a 90 percent stake in Hong Kong self-storage provider RedBox Storage Limited on Monday. The initial commitment of $50 million will be used for a series of property acquisitions across the city, the investment firm said in a statement.

“This is an exciting time for RedBox as it continues to develop into the market leader in Hong Kong,” said Stuart Jackson, CEO of InfraRed NF in a statement. “Ownership of their properties provides an attractive real estate investment opportunity in a market where demand for self-storage is high and supply is constrained by the Government revitalisation programme and regulations following the 2016 fire in Ngau Tau Kok.”

InfraRed Likes to Put Its Money Into Boxes

Founded in 2014 by real estate investment manager E3 Capital Partners, Hong Kong-based RedBox, which offers amenities like climate control and 24-hour security in its locations, is expanding to provide flexible bespoke storage solutions for individuals and business in the city, according to the statement.

“InfraRed NF’s investment will be used to expand our existing operations across additional sites in Hong Kong and further develop our technology and logistics platform to continue to lead the industry into the next generation of self-storage,” said Simon Tyrrell, CEO of RedBox in the statement.

RedBox is InfraRed’s second investment in the self-storage market in the past 12 months. Just last May, the firm invested $28 million in China Mini Storage, a technology-led self-storage provider in mainland China.

Based in Hong Kong, InfraRed NF is a joint venture between British investment firm InfraRed Capital Partners and Vervain Resources, and investment affiliate of Hong Kong property developer Nan Fung Group. InfraRed NF focuses on private equity investments in the Greater China real estate market.

Niche Segments Gain Ground as Investors Search for Yield

InfraRed’s investment comes as institutional investors in Asia are increasingly turning to alternative real estate asset classes as rising asset values squeeze investment yields in core sectors such as office space. As one of the fastest growing segments in a group of alternative real estate classes that typically includes warehouses, senior housing and data centres, self-storage facilities are expected to benefit from the growth Asia’s urban population, which is charted to reach more than 400 million people by 2027, according to property consultancy JLL.

“In Hong Kong, record high prices and ultra-low property yields are driving an increasing number of investors to take a closer look at alternatives in the local real estate market. These include student housing, senior housing, co-living, education, self-storage, car parks and data centres,” said Denis Ma, Head of Research at JLL. “For investors, alternatives can often generate rental yields 100-2,000 basis points higher than more traditional real estate assets.”

Institutional buyers including REITs, private equity funds, investment managers, real estate operating companies and developers spent $43 billion in alternative assets globally in 2016, said JLL.

Self-Storage Starts to Consolidate in Asia

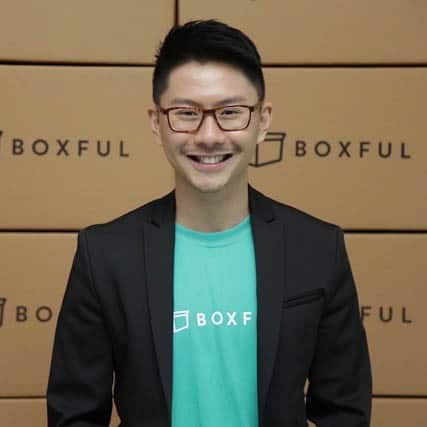

Casper Koh, General Manager at Boxful Taiwan, sees Taiwan a booming market for the shared storage market

The growing interest in Asia’s alternative real estate classes is driving consolidation in the self-storage sector in the region. Earlier this month, Hong Kong-based self-storage provider Boxful acquired its Taiwanese competitor ALL IN Premium Storage for an undisclosed amount, according to a statement from Boxful.

“High housing prices and small living space in Taiwan have driven the rise in of the shared storage market. After entering the Taiwan market for less than two years, Boxful has had an average monthly growth rate of 20 percent,” said Casper Koh, General Manager at Boxful Taiwan in a statement. “We are very optimistic about the prospects of the greater Taipei mini-warehouse market. There we want to accelerate market consolidation through acquisitions. By acquiring ALL IN’s corporate customers, we are able to expand our scale to enhance efficiency.”

The Hong Kong startup entered the Taiwan market in 2016 a year after its launch a year earlier. The Taiwan unit of Boxful now operates in four northern cities including Taipei, New Taipei, Keelung and Taoyuan.

The deal comes just four months after the Hong Kong mini-storage service provider closed a fundraising round by securing HK$140 million ($18 million) from property developers like Shimao Property Holdings, Shui On Land and Nan Fung Group in December. Its series A funding round, which raised HK$51.1 million ($6.6 million) in June, 2015 attracted investors like First Great Eagle and Arocrest Capital.

Leave a Reply