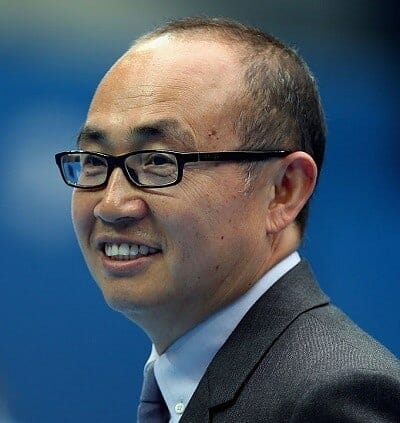

Soho China chairman Pan Shiyi plans spin off co-working 3Q

Beijing-based developer Soho China plans to spin off its co-working business 3Q into a separate company, chairman Pan Shiyi said in a press conference last week, according to media reports. The flexible office space provider, one of the largest players in mainland China, also aims to double its number of co-working desks to 50,000 this year.

The ever media-friendly Pan said that his Hong Kong-listed builder has not yet decided on the timing and listing venue for an IPO of its flexible office unit. Founded in 2015, the co-working space provider has 26 co-working centres with around 26,000 desks across Beijing, Shanghai, Hangzhou, Shenzhen and Nanjing. The majority of 3Q’s centres are located in Beijing and Shanghai where it has a combined 17,000 desks in 19 locations.

Soho’s ultimate goal is for 3Q to ultimately provide 500,000 desks across China, Pan said in August last year.

Soho Races Kr Space and Naked to Co-Working IPO

A Soho 3Q centre in Beijing

As more mainland firms expand into co-working, Soho China is not the first mainland corporate to see a profit opportunity in a flexible office spin-off. Alibaba-backed technology platform 36Kr spun off its Kr Space unit in January 2016, and has raised a combined $1.1 billion after completing a $92 million financing round earlier in January. Venture capital firms IDG Capital, China Minsheng Investment Management, Gobi Partners, Unity Ventures, Colony New Yangtze Fund, and Prometheus Capital, a fund established by Chinese tycoon Wang Jianlin’s son Wang Sicong are among the investors in Kr Space.

Soho 3Q may also find itself in a race with Shanghai-based competitor naked Hub to become the first mainland co-working operator to go public. Last October, naked Hub, which is itself a spinoff of resort operator naked Group, revealed plans for a Hong Kong listing. Grant Horsfield, the chairman of the startup, said the 18-centre flexible space provider would seek a public listing within a few years, according to a Reuters account.

Soho Takes a Break From En Bloc Sales

Beijing-based Soho China, which made headlines for its series en bloc asset sales in the past two years, also said in the conference that it has no plans to sell any more assets. The statement comes after it offloaded a Zaha Hadid-designed project on the western edge of Shanghai to Hong Kong-based private equity firm Gaw Capital for RMB 5.01 billion ($754.1 million) in late October.

The transaction followed Soho’s disposal of another mixed-use project in an emerging commercial district of Shanghai for RMB 3.6 billion ($525 million) in last June. And earlier in July 2016, the Beijing developer sold Soho Century Plaza, a commercial project in Pudong district, for RMB 3.2 billion ($485 million).

Leave a Reply