Asia Pacific Land and friends has just disposed of Shiba Park Building for $1.4 billion

A group of investors led by Hong Kong-based Asia Pacific Land have sold the Shiba Park Building, once Japan’s most expensive en bloc asset, for a reported 150 billion yen ($1.4 billion), according to Tokyo-based brokerage Japan Property Central.

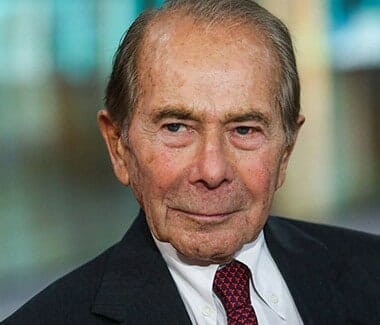

Asia Pacific Land, along with partners that include Maurice “Hank” Greenberg’s CV Starr, the Abu Dhabi Investment Council and Hong Kong-based alternative investor PAG are said to be selling the large footprint 14-story building to a group of Japanese companies led by utility Kansai Electric Power and Tokyo Gas, in what would be Japan’s second-largest single asset real estate deal since the 2008 financial crisis.

Commonly referred to as the “battleship” building among locals, the Shiba Park Building was once the most expensive single building in Japan when Morgan Stanley sold it to daVinci Holdings for 143 billion yen in 2005. The office building was later acquired by Asia Pacific Land’s consortium in 2013 for 110 billion yen ($1.1 billion), as one of Japan’s largest single-asset deals that year.

The 6,000 square metre per floor property was reported to be put on the market in late 2015 with an asking price of 160 billion yen ($1.3 billion).

APL, ADIC, CV Starr and PAG Sell Out After Five Years

The Shiba Park building sale provides an exit for Hank Greenberg’s CV Starr

Asia Pacific Land’s erstwhile asset has a total floor area of 97,294 square metres (1.05 million square feet) and sits on a 16,150 square metre site. The building is connected to the JR East Railway via Hamamatsucho station, to Toei Transportation by the Daimon station and Shiba Koen Station in walking distance. The building’s new owners are said to have plans to redevelop the 1982 vintage building.

The current owners acquired the Shiba Park Building in 2013 for more than 125 billion yen when Tokyo’s real estate market was just beginning to recover, and are said to have refinanced the asset in 2016, after an earlier attempt to sell the building failed to generate sufficient interest.

Privately held Asia Pacific Land has invested in a portfolio of properties across Asia including the 37-storey K.Wah Center on Huaihai Middle Road, Puxi, Shanghai and the 10-storey Tiffany Building in Japan’s luxury commercial district Ginza. The investment company has offices in Hong Kong, Tokyo, Taipei, Shanghai, New York, and Los Angeles, its corporate website shows.

Energy Suppliers Team Up For Real Estate Investment

The gas provider and electric company duo which bought Shiba Park, have already cooperated in liquefied natural gas procurement in 2016, and will further extend their partnership by considering a strategic alliance in real estate business, according to a statement from Tokyo Gas last week.

“We share mutual knowledge in real estate business. In addition, we will set the

people-to-people exchange to improve both business organizations,” said Tokyo Gas on the alliance.

Tokyo Market Stays Popular with Global Institutions

The Shiba Park transaction is second only to GIC’s estimated 170 billion yen purchase of the Pacific Century Place Marunouchi skyscraper in Tokyo in 2014.

The Singaporean sovereign wealth fund returned to Japan’s capital in December of last year to acquire a 43 percent stake in Shinjuku MAYNDS Tower, a 97,978 square metre Grade-A office property for 62.5 billion yen ($558 million), from Daiwa Office Investment Corporation.

In the same month, PGIM Real Estate, a property investment affiliate of Prudential Financial, purchased an 18-story office building with a three-story office annex in Fuchu City, a suburban area near Tokyo’s central business district.

Leave a Reply