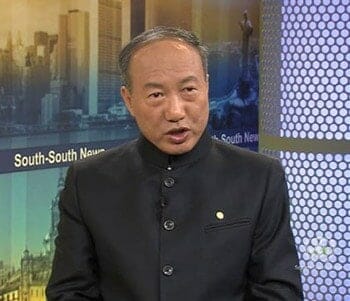

Sunac chairman Sun Hongbin, HNA’s white knight.

Chinese tycoon Sun Hongbin, who bailed out Wanda Group last year, is coming to the aid of a struggling mainland developer again. HNA Infrastructure Investment Group, a listed subsidiary of embattled HNA Group, said in two separate filings to the Shanghai Stock Exchange on Monday evening that it plans to sell a property unit and a logistics unit to Sunac China for a combined RMB 1.9 billion ($300 million).

HNA Infrastructure Investment will sell its 100 percent stake in Hainan Gaohe Property Development to Hainan Sunac Chang Sheng Estates (HSCSE), a subsidiary of Sunac China in Hainan for RMB 1.13 billion ($179 million). The property firm’s businesses include property development, realtor services and tourism project development.

In a separate filing, the HNA unit announced it will sell its 100 percent stake in Hainan Haidao Construction Logistics, a logistics company providing warehousing services, to HSCSE for RMB 797 million ($126 million).

“The sales will help the company to integrate its resources, optimise asset structure, drive strategic transformation, accelerate its infrastructure construction business, and boost overall profitability,” HNA Infrastructure Investment said in the statement. The HNA subsidiary added it would gain RMB 437 million ($69 million) through the deals.

Tianjin-based conglomerate Sunac China said the deals are one-off local project transactions, and that the firm is not cooperating with HNA in a broader sense, according to local media reports.

Sun Hongbin Keeps Foot on the Gas Despite Debts

Sunac is actively acquiring assets from other developers despite its mounting debts. In January, Sunac joined an investor group led by Tencent to buy a 14 percent stake in Dalian Wanda Commercial Properties, which has a portfolio of nearly 240 shopping centres across China, for RMB 34 billion ($5.37 billion).

Last July, Sunac agreed to buy a 91 percent stake in a portfolio of 13 “Cultural Tourism City” theme park projects, which was valued at RMB 29.6 billion, from the Beijing-based developer.

Apart from real estate acquisitions, Sunac bet on a $3.2 billion redevelopment fund with US private equity giant Warburg Pincus this month to redevelop ageing commercial properties in first-tier and key second-tier cities in China.

While Sunac’s purchases helped make it the country’s fourth-biggest developer in 2017 by contracted sales, it has also become among the country’s most indebted. Sunac China had a 394 percent net gearing ratio in the first half of last year.

HNA Stays in Sell Mode

HNA’s chairman Chen Feng is selling two Hainan companies to Sun Hongbin

From internal restructuring to ongoing sales of assets, HNA is struggling to escape its financial crisis after amassing an estimated $100 billion in debt. Just a few days ago, Hainan Airlines, the flagship carrier of HNA Group, announced it would take over the group’s hotel business and an unnamed overseas hotel operator, along with several aviation businesses.

The airline turned conglomerate was reported Monday to be in talks to dispose of some or all of its 25 percent stake in Hilton Grand Vacations, a Hilton Worldwide spinoff. Last week, HNA Group announced the proposed sale of its $1.4 billion stake Park Hotels & Resorts Inc, a REIT that owns a portfolio of 50 hospitality properties across the US, Europe and Latin America.

The planned stake sale was followed by the group’s third disposal of a site in Hong Kong’s former Kai Tak airport area. HNA sold one of its remaining pair of Kai Tak plots to Wheelock and Company for $811 million on Friday.

Leave a Reply