ANREV saw fund managers raising more cash in 2021 (Source: ANREV)

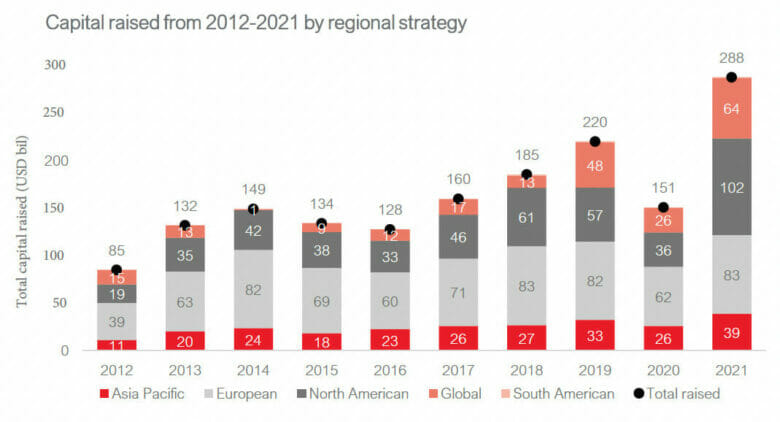

Capital raising for private funds targeting Asia Pacific real estate hit a record high of $39 billion in 2021, up sharply from the $26 billion raised in 2020, according to a survey released late last week by a group of non-profit organisations serving the property investor community.

The 50 percent surge came as capital raised through private funds accounted for 61 percent of the total capital raised for real estate investment in APAC last year, the Capital Raising Survey 2022 revealed. By comparison, private funds were the vehicle for 56 percent of capital raised for real estate worldwide.

The study by the Asian Association for Investors in Non-Listed Real Estate Vehicles (ANREV), its European counterpart INREV and Chicago-based fiduciary association NCREIF was based on a poll of fund managers.

“This year’s Capital Raising Survey shows an exceptional recovery of the global real estate markets indicating strong investor appetite for the non-listed real estate asset class in Asia Pacific and globally,” said Amelie Delaunay, director of research and professional standards at ANREV. “The share of capital raised but not yet invested is higher than in the previous year indicating some challenges in deploying capital globally. And it is interesting to see investors moving up the risk curve and deploying more capital towards riskier strategies in the region.”

Soaring to New Highs

Capital sourced from APAC investors also reached a peak at $52 billion, representing 26 percent of the global total capital raised. European investors remained the largest contributor with 41 percent, followed by North American investors with a third of total capital raised.

Amélie Delauney, director of research and professional standards at ANREV

Worldwide, a record $288 billion was raised for non-listed real estate investment. North America-focused strategies raised $102 billion, nearly tripling the $36 billion figure of 2020, while global strategies drew $64 billion, up from $26 billion the year before. European strategies raised $83 billion, equalling their previous record set in 2018.

Of the capital raised for non-listed funds in APAC, core remained the most attractive strategy with 43 percent of the capital raised, followed by opportunistic strategies with 41 percent.

Funds with a single country strategy raised 78 percent of the capital, the report said, and 86 percent of the capital raised for multi-country funds was raised for core strategies. Single-sector strategies attracted 77 percent of the capital raised for funds, with industrial and logistic strategies accounting for 59 percent of the total capital raised.

Giants Flex Muscle

The big names cashing up for APAC property investment in 2021 included private equity giant Blackstone, which raised $6.38 billion for its Blackstone Real Estate Partners Asia III during the year.

Mingtiandi reported last week that BREP Asia III had reached $7.5 billion in committed capital in the first quarter of this year, 83 percent of the way to its target size of $9 billion.

In late December, Blackstone rival Warburg Pincus announced a final closing on $2.8 billion for the firm’s first-ever dedicated Asia real estate fund, making it the second-largest opportunistic real estate investment vehicle currently active in Asia.

In November, Hong Kong’s Gaw Capital Partners said it had raised $1.2 billion in equity for the seventh edition of its opportunistic real estate strategy targeting APAC, marking a first closing on its way to a $2.5 billion target for the closed-ended fund.

Leave a Reply