Lee Kok Sun, Chief Investment Officer, GIC Real Estate

Singapore’s GIC is continuing a string of outbound mega-deals by partnering with a Japanese REIT to buy the largest hotel in the Tokyo Disney Resort area for around 100 billion yen ($909.1 million). Under the terms of the deal, the sovereign wealth fund is taking a 51 percent stake in the asset for $463.6 million.

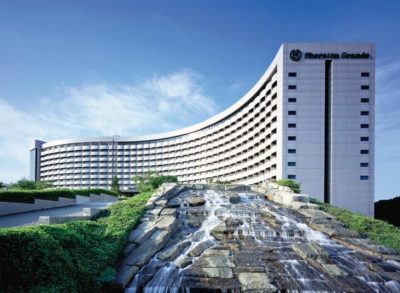

GIC will enter into a joint venture with Invincible Investment Corporation, a Tokyo-listed public hotel and residential real estate investment trust, for the acquisition of the Sheraton Grande Tokyo Bay Hotel, the company announced on Thursday.

The partners are purchasing the 1,016-room luxury resort hotel from US alternate asset manager Fortress Investment Group, which picked up the property in 2013 for an amount reported to be roughly half its current price tag. The transaction marks one of GIC’s biggest investments in Japan and adds to the fund’s billions of dollars in overseas property acquisitions in the past year.

Betting on Tourist Arrivals to Bolster Disney-Area Hospitality

Sheraton Tokyo Bay is one of the six “official” hotels within the Tokyo Disney Resort area, not counting four Disney-branded hotels, and is adjacent to the resort. Built in 1998, the five-star hotel includes a 175-room Annex Tower which opened in December 2016. The property is the only hotel operated by Marriott International within the resort area, which is located about an hour’s drive from Tokyo in the city of Urayasu, Chiba.

The Sheraton Grande Tokyo Bay Hotel changed hands for about $909 million

Following the acquisition, which is expected to take place on October 13 according to a filing by Invincible, the hotel will continue to be managed by Marriott subsidiary Starwood Hotels and Resorts. The property generated a net operating income of around 4.3 billion yen ($36.5 million) in 2016.

“Sheraton Grande Tokyo Bay Hotel, with its close proximity to Tokyo Disney Resort, has shown strong and resilient cash-flows,” commented Lee Kok Sun, Chief Investment Officer for CIC in a statement. “As a long-term value investor, we are confident in the continued growth and demand in Japan.”

The sovereign wealth fund indicated that it hopes to up the return on the acquisition by making improvements on the year-old property. “In partnership with Invincible Investment Corporation, we will seek to enhance the Sheraton Grande Tokyo Bay Hotel and support it in its next phase of growth,” Lee added. “We have been investing in Japan for more than 20 years and are continually on the lookout for quality assets with stable cash-flow potential.”

The partners are expecting a tourist upsurge and a scarcity of rooms in the area to sustain high demand for the hotel. Tokyo Disney Resort, which includes Tokyo Disneyland and Tokyo DisneySea, has received a steady stream of about 30 million visitors a year for the past several years, according to Invincible. Despite receiving 29,018 visitors per day from other regions of Japan and overseas, the resort area offers only 8,134 guest rooms in total.

Adding to the hotel’s investment appeal, a record high number of visitors is anticipated in 2020, when Tokyo will host the Summer Olympics. Japan’s Oriental Land Company, the operator of Tokyo Disney Resort, plans to invest some $682 billion in new attractions that are scheduled to open in the spring of 2020, together with a large-scale “themed port” attraction being planned for Tokyo DisneySea.

GIC Continues an Outbound Acquisition Binge

GIC, which manages Singapore’s foreign reserves, is ranked as the world’s eighth-largest sovereign wealth fund with an estimated $359 billion in assets under management. In 2014 the fund bought the Pacific Century Place Marunouchi office tower in Tokyo from a unit of Hong Kong-based investment manager PAG, in a deal worth $1.5 billion.

More recently, GIC spent about $4 billion on US real estate in less than a year when it paid $2 billion for a stake in Denver-based trailer park operator Yes! Communities in August 2016, bought a Manhattan office tower for over $1 billion in January of this year, and scooped up office space valued at more than $1 billion in and around Washington DC in February.

Among other major deals this year, GIC also spent around $1.4 billion on a stake in India’s most valuable developer, DLF, last month. And earlier this week, a fund backed by GIC completed its acquisition of US luxury apartment builder Monogram for a total value of around $4.4 billion.

Leave a Reply