Robert Wong, Chief Executive of Hongkong Land (right)

Hongkong Land is boosting its presence in Singapore by teaming up with a leading Malaysian developer to build and manage a pair of office towers within the Marina Bay Financial District, the companies announced Monday.

The Hong Kong-based property firm has agreed to pay S$940 million ($682 million) for a 33 percent stake in a commercial project on Central Boulevard which Malaysia’s IOI Properties had purchased at auction for S$2.6 billion ($1.9 billion) last November, according to a statement to the Malaysian stock exchange. Kuala Lumpur-listed IOI will retain a 67 percent share of the joint venture in a transaction that values the project at S$2.84 billion ($2.06 billion).

The international real estate duo propose to build a prime office project with around 1,260,000 square feet (117,058 square metres) of leasable space and a small retail podium spanning about 30,000 square feet (2,787 square metres) on the site. The development marks the Malaysian property giant’s second major commercial investment in Singapore as the country’s prime downtown office market begins to recover from a two-year slump.

Hongkong Land Wants a Bigger Piece of Marina Bay

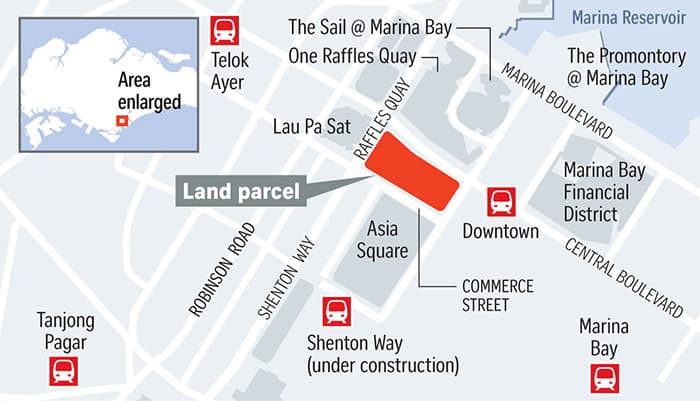

The land parcel to be developed is a “white” site, one that allows the developer to decide on the mix of uses, adjacent to One Raffles Quay in the heart of Singapore’s financial district. IOI Properties scooped up the 1.1 hectare (2.7 acre) site last November in a fiercely contested bidding process after Singapore’s planning authority offered the site for sale by public tender the previous August. The acquisition marked the first land sale in Marina Bay for nine years, and set a record for Singapore’s most expensive government land sale at S$1,689 per square foot.

“Our new joint venture allows Hongkong Land to expand its portfolio of prime commercial properties in Marina Bay and demonstrates our long-term confidence in the Singapore property market,” commented Robert Wong, Chief Executive of Hongkong Land.

The Central Boulevard site lies between Marina Bay Financial Centre (right foreground) and One Raffles Quay (right background)

The proposed development, called Central Boulevard, will connect One Raffles Bay to Marina Bay Financial Centre, both of which are managed by Hongkong Land. Located to the northwest of the site, One Raffles Quay is a pair of prime office towers jointly developed by Hongkong Land with Cheung Kong Property Holdings and Singapore’s Keppel Land which was completed in 2006. Hongkong Land partnered with the same pair of Asian developers to build Marina Bay Financial Centre, a landmark mixed-use complex to the southeast of the Central Boulevard site, completed in 2012.

Hongkong Land apparently linked up with fellow Hong Kong developer Cheung Kong on an unsuccessful bid for the Central Boulevard site last year. Marina Central Development Pte. Ltd., a Singapore-registered company that is reportedly a joint venture between the two property firms, was one of the seven finalists for the site before losing out to IOI with a tender of S$2.1 billion.

“We look forward to working with our partner Hongkong Land on this exciting new development, which will bring office space of the highest quality to Singapore’s premier Central Business District,” said Lee Yeow Seng, CEO of IOI Properties in the announcement.

Betting on a Singapore Office Rebound

The investment raises Hongkong Land’s profile in Singapore, where the company already holds 165,000 square metres of high-end office property, mainly through joint ventures. The London-listed property wing of Jardine Matheson Group, owns and manages a total of 800,000 square metres of prime office and luxury real estate in Asia, including 450,000 square metres of landmark properties in downtown Hong Kong, from Exchange Square to Jardine House.

Map of Marina Bay (Source: URA, Straits Times)

The tie-up with IOI Properties comes less than a month after Hongkong Land tried and failed to secure another Singapore site. In late May, a pair of mainland Chinese developers placed a record-breaking S$1 billion ($722 million) bid for a residential site in the island nation, trumping a S$926 million ($668) tender by Hongkong Land affiliate MCL Land.

For IOI Properties, Malaysia’s largest listed developer by market cap, the deal is an opportunity to bring another high-profile office property to the Asian financial hub. Starting in 2007, the company has ventured into four residential developments in Singapore and is also building South Beach, said to be the country’s largest mixed-use complex, in concert with a local developer.

The proposed Central Boulevard project is expected to benefit from a shortage of office space in Singapore after a wave of new office completions tapers off by 2018. Although prime office rents in Singapore’s financial district have dropped by 10 percent over the past two years, the dearth of available space forecast for 2018 through 2021 should enable the new office towers to command premium rents due to pent-up demand.

Leave a Reply