PCCW expanded into Malaysia by acquiring this Cyberjaya asset in September

Hong Kong-based telecom operator PCCW is selling its data centre business to DigitalBridge, a New York Stock Exchange-listed real estate investment trust that was known as Colony Capital until one month ago, for $750 million, according to a notice to the Hong Kong stock exchange.

The deal for PCCW DC, the Hong Kong firm’s internet infrastructure division, provides DigitalBridge, which took on its new identity in June as part of a pivot towards tech investments, with nine data centres spread across Hong Kong, mainland China and Malaysia. The network provides a combined 75 megawatts of power capacity at a time when server facilities have become among the world’s most sought-after assets.

“As an experienced investor in the global data centre sector, DigitalBridge’s expertise investing in, building, and operating data centres to the highest standards aligns perfectly with PCCW DC’s next stage of development,” said Marc Ganzi, who took over as president and chief executive of Colony Capital one year ago when founder Tom Barrack stepped into an executive chairman role.

The Hong Kong transaction comes about seven weeks after Colony Capital agreed to sell rights to management of its $2.7 billion in non-tech related real estate funds to Softbank-backed Fortress Investment Group, and less than one week after Barrack and a former Colony executive were indicted by the US Department of Justice on charges of acting as agents of a foreign government.

Cyber Li Sells Hong Kong-Centric Business

Newly rebranded Colony’s deal for PCCW’s data centres gives it 100 percent ownership of a pair of business units, Powerbase HK, which operates in Greater China, and DC Malaysia, which holds one 6MW asset in the Southeast Asian nation’s Cyberjaya outside of Kuala Lumpur.

Richard Li is selling while data centres are hot

In Hong Kong, the business owns seven data centres that provide a combined 65MW of power, with the sole mainland facility in Guangzhou maxed out at around 2.4MW.

PCCW said it expects to gain around $180 million on the disposal of a business that brought in net profit after tax of $2.6 million in 2020.

In its statement, the company chaired by Richard Li, the younger son of Hong Kong tycoon Li Ka-shing, said it was disposing of the data centres to streamline its operations in order to focus on technology, intellectual property development and services, as well as to provide capital allocation flexibility and “crystallise value of the data centre business”.

Base for Expansion

DigitalBridge, which operates a pair of US data centre networks with locations in North America and Europe, portrayed the investment in PCCW DC as an opportunity to build an Asian platform.

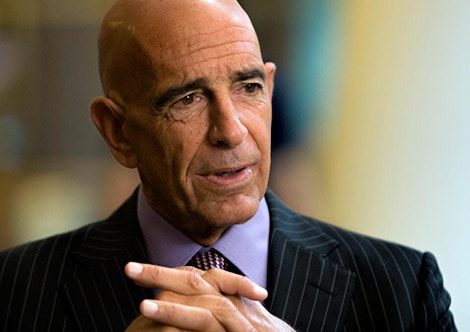

DigitalBridge CEO Marc Ganzi

“They are already a leading operator in the region and are poised for significant growth, with a strong development pipeline and considerable expansion capacity,” Ganzi said. “This is a terrific platform for DigitalBridge to expand its regional presence while supporting a strong management team focused on serving many of the same hyperscale and large enterprise customers that DigitalBridge works with on a global basis.”

In addition to the nine projects currently in operation, in its most recent annual report PCCW said it had confirmed a new data centre location in Hong Kong’s Tsuen Wan West, which is targeted for completion in 2022.

PCCW officials opening a new data centre in Hong Kong last year

In a presentation to investors last month, DigitalBridge executives said their 2021 priorities for the company included plans to build hyperscale data centres in Asia. A Bloomberg report in April indicated that Li had put PCCW’s data centre business on the market at a target price of $1 billion.

In the US, DigitalBridge owns data centre operators Vantage and DataBank, which Ganzi’s DigitalBridge firm had acquired before being bought out by Colony in 2019 for $350 million.

Pivot to Tech

The Asia data centre deal is the latest step in a transition to technology signalled by Colony’s name change last month, after Barrack’s firm had said in 2019 that it aimed to evolve into “the leading owner and investment manager of assets, businesses, and investment management products in which the digital and real estate frontiers intersect”.

The deal with Fortress last month took that evolution a step further by clearing out Colony’s remaining real estate assets and fund management business.

“Fortress is a world-class organization, so I know these assets will be stewarded and managed in the most responsible way going forward, allowing us to maintain our singular focus on building the most compelling digital infrastructure REIT in the world,” Ganzi said in a statement at the time.

Unregistered Foreign Agent Charges

Ganzi may find his days busier than ever, even without the PCCW deal, as his boss fights charges of attempting to influence the Trump administration on behalf of Emirati clients. Colony has a record of having received significant support for its funds from UAE and Saudi sources. A close friend of former president Trump, Barrack chaired the inaugural committee that raised a record $100 million to welcome the new administration in 2017.

Colony chairman Tom Barrack is out on $250M bail

“As alleged, the defendants, using their positions of power and influence in a presidential election year, engaged in a conspiracy to illegally advance and promote the interests of the United Arab Emirates in this country, in flagrant violation of their obligation to notify the Attorney General of their activities and in derogation of the American people’s right to know when a foreign government seeks to influence the policies of our government and our public opinion,” acting US attorney for the Eastern District of New York Jacquelin M Kasulis said in a statement.

US prosecutors said that after Trump was elected in 2016, Barrack suggested that senior UAE officials provide him with a “wish list” of foreign policy action that they wanted from the new administration, according to a New York Times account.

Barrack is said to have pushed Trump administration officials not to hold a summit with Qatar, a rival of the UAE. The 74-year-old is currently free on $250 million bail, and representatives have indicated that Barrack intends to plead not guilty to the charges.

Leave a Reply