Source: JLL

Shanghai ranked as the top city for real estate investment in Asia Pacific in 2016 thanks to a $3 billion surge in major transactions from the previous year, according to figures published by JLL.

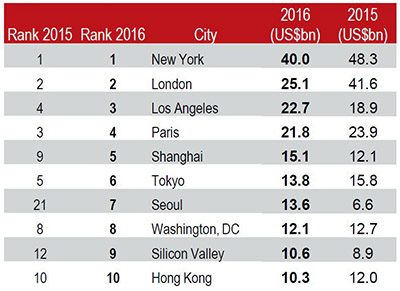

The mainland financial centre ranked fifth globally with $15.1 billion in investment transactions of real estate assets, according to a report released this week by the international property consultancy. The city of more than 20 million people ranked behind only New York, London, Los Angeles and Paris for property investment volume for the year.

Shanghai’s investment volume was still $25 billion behind New York’s $40 billion in transactions, while London ranked second with $25.1 billion in deals last year. In the third spot was Los Angeles with $22.7 billion in deals, while Paris notched $21.8 billion in buildings changing hands.

Busy Fourth Quarter Provides a Boost

Joe Zhou of JLL China

A burst of investment activity in the fourth quarter, including the $2.91 billion acquisition of Cheung Kong Properties’ Century Link complex in Pudong, helped to push Shanghai into the top position for the region. That purchase, by a fund managed by ARA Asset Management and invested by China Life, stood out as the biggest single-asset property transaction in Asia Pacific in 2016.

The city’s performance was helped by restrictions on capital outflows put in place by China’s government, which have bottled up Chinese capital and boosted competition for mainland assets. “Domestic capital was the main driver of real estate transaction volumes in 2016, with domestic investors often outbidding foreign investors in many transactions,” said Joe Zhou, head of research for China at JLL.

In the retail sector, the largest transaction of the year in Shanghai was Chongbang Development’s $825 million buyback of an 80 percent equity stake in the Jinqiao Life Hub from Singapore’s Alpha Investment Partners and Keppel Land China.

APAC Deals on the Rise While US Transactions Slide

While Shanghai’s investment volume was less than 38 percent of New York’s, the mainland city is closing the gap with the world’s top real estate destinations – thanks to 2016’s $3 billion rise in deal traffic. By contrast, New York’s investment volume dropped by more than $8 billion during last year.

Across Asia Pacific total real estate transaction volumes grew by five percent in 2016 and were up 21 percent year-on-year in the fourth quarter, according to JLL.

Leave a Reply