“Yeah, hi. When you bring me my 6.5% to 7.0% GDP growth this year, please leave off the frothy real estate market”

China’s top leadership held its biggest annual economic meeting last week and the Central Economic Work Conference ended with the country’s planning authorities, led by President Xi Jinping, agreeing that, “Maintaining stability while seeking progress” should be the mainland’s watchwords in 2017.

However, a quick scan of China’s increasingly volatile real estate markets shows that maintaining stability in the property sector could be directly at odds with maintaining the economic growth that the country’s leadership sees as critical to preserving its harmonious society.

With home sales and real estate investment levels already showing signs of tapering in recent months following a policy squeeze, China’s quest for stability could just be leading it into a fresh round of stimulus measures aimed at the housing market, followed by yet another season of rolling out home purchase restrictions.

Top Leaders Warn Against Property Speculation

The priorities set at the conference comes as China’s leaders prepare to set a target for top-line economic growth in the new year, with the State Information Center, an official think tank affiliated with the National Development and Reform Commission (NDRC), having recently recommended a target of 6.6 percent for 2017. The target for next year is in line with this year’s stated goal of between 6.5 and 7.0 percent, and through the first three quarters of this year, China reported 6.7 percent GDP growth.

The real estate market, which saw rapid growth during the first half of 2017 and has raised concerns of a housing bubble, was singled out for particular attention at the Work Conference, with an official statement recommending that China keep its property market stable and healthy, and admonishing China’s housing happy investors that “properties are for residential use, not speculation.”

The show of concern for the real estate market is in tune with a series of locally targetted but centrally directed moves to regulate an overheated property market this year, including repeated increases in down-payment requirements and tighter credit policies towards home loans.

A survey of home prices in 100 major Chinese cities shows that the market cooling measures have been largely successful in recent months, with home prices rising an average of just 0.88 percent in November, after popping up by double-digit levels in the China’s largest cities during the early months of 2016.

Emphasis on Stability a Switch From Push for Growth

Investment in new real estate projects has been slowing since April this year

The conference’s emphasis on a stable market comes just one year after the same policy-setting meeting pointed to stimulating sales of homes, particularly in smaller cities, as key to economic growth. That recommendation came after China had sliced down payment requirements to 20 percent in a majority of cities. That policy measure was an attempt to jump start the housing market after growth in real estate investment slowed to just one percent in 2015, compared to the previous year.

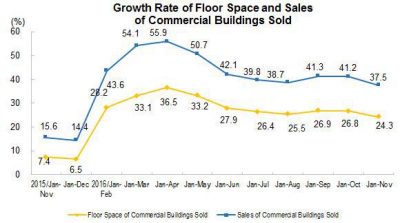

Coming after a series of interest rate cuts and repeated reductions in bank capital reserve requirements, as well as unstated policy of turning a blind eye to riskier lending practices targetting housing down-payments, such as peer to peer loans, jumps in home prices of more than 40 percent in Shenzhen, and over 30 percent in some of the country’s leading provincial capitals helped to coax developers into once again taking on projects. With the growth rate in home sales over the first 11 months of the year now up by 37.5 percent in value, developers have invested 6.5 percent more over the same period, compared to 2015, according to official statistics.

Moody’s Analytics estimates that real estate accounted for around 15 percent of China’s GDP in 2015, and the parallel upswings in China’s overall economy and its property market indicate that the country’s reliance on property investment for growth has not decreased.

Real Estate Investment Growth Slowing, and So Might the Economy

Growth in home sales has been tapering since April. Source National Bureau of Statistics

China’s real estate growth spurt has largely tapered off in recent months, however, as more of the country’s economic centres have come under strict home purchase restrictions. While the percentage growth rate in home sales is still up for the year, that rate of increase has been sliding since it peaked at 55.9 percent in April. The slowdown in home sales has already begun to make developers more cautious, with growth in investment down from a peak rate of 7.2 percent in April.

This slower growth comes as the country’s economic leadership has rapidly replaced stimulus for the housing market with home purchase restrictions and stringent control of mortgage lending. In Shanghai, sales of homes recently reached a three month low this month following yet another hike in minimum down-payments.

The part of the housing market story that has yet to be told is whether China can continue its cheerful economic forecast without support from a high-revving real estate market. With the government seemingly prioritising a “harmonious society” over all else, a slowing housing market could quickly put pressure on the economy and lead to yet another cycle of policy loosening and rising home prices as we progress into 2017.

Leave a Reply