Wang Jianlin’s investors are holding out for a higher price

After halting trading of Hong Kong-listed shares in his Dalian Wanda Commercial Properties more than a month ago, the path for Wang Jianlin to achieve his much-desired mainland listing is getting muddier as the Hong Kong stock exchange appears to be holding up the billionaire’s plans.

The city’s Securities and Future’s Commission, which regulates its stock market, has been questioning Wanda’s plan to buy back its Hong Kong shares, according to an account in Reuters. The commercial property developer, which went public just 18 months ago in a $3.7 billion IPO, was the exchange’s biggest new listing of 2014.

Now Wang is using a special private equity-backed vehicle to buy back his Hong Kong shares after the stock slumped well below its IPO price in recent months, but he is meeting resistance from some of the cornerstone investors in his Hong Kong enterprise, as well as facing obstacles from regulators on the mainland and in Hong Kong.

HK Regulator Wants Answers Before Giving the Green Light

Wanda’s shareholders seem to have rapidly lost their faith in the mall empire after it was listed in Hong Kong

Wang is facing pressure from a two year time limit that he put on his Wanda relisting plan, which obligates him to pay out at a 12 percent return to the financial backers of his buyout scheme should Wanda not achieve a new listing on a mainland exchange within that time frame.

However, the Reuters report cites Wanda insiders as saying that the Securities and Futures Commission is refusing to let the buyout move forward until the company answers question. The nature of the regulator’s queries was not specified, but the developer has yet to publish details up its delisting, which it earlier had said would be ready by May 2nd.

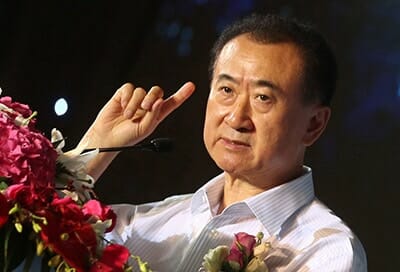

Speaking in an interview on China’s state television network earlier this month, Wang Jianlin said that Wanda Commercial “must be taken private” because the former army officer believes that Hong Kong stock investors are undervaluing the company, and that he “feels sorry” towards his investors.

Hong Kong Investors Demand Higher Return

While Wang seems to have warm feelings toward the investors in his Hong Kong-listed stock, these shareholders seem to be holding out for more than just kind words.

Earlier indications of the buyout price for Wanda had Wang offering his Hong Kong shareholders the same HK$48 per share that the stock was valued at during its IPO. The stock had slid to just HK$31.55 per share in March, before news leaked of the buyout plan, however, investors interviewed by Reuters were asking for pricing well above the original IPO price before agreeing to sell their shares.

Cornerstone investor Timing Investment, which bought $100 million worth of Wanda Commercial shares in the IPO is reportedly asking for at least a 15 percent markup over the IPO price, and a Singapore-based hedge fund manager that manages around three percent of the developer’s shares is said to have indicated that the buyout offer needs to be at least 10 percent over the IPO level.

Wang also faces uncertainty regarding his plan from mainland sources, where regulators have been discouraging companies from following the trend of re-listing their shares on domestic exchanges out of fear that these stocks could flood a market which is still recovering from last year’s slide in equity prices. Despite stated concerns by China’s stock regulator, Wang has repeatedly confirmed his plans of seeking a mainland listing, and says that he is already in discussion with the relevant authorities.

[…] Is Hong Kong Blocking Wang Jianlin’s Buy-Back | Mingtiandi […]