Anbang chairman Wu Xiaohui may find himself under the spotlight of China’s insurance regulators

Anbang Insurance’s abrupt and unexplained withdrawal from a $14 billion bid for Starwood Hotels and Resorts last month came as a surprise for many observers who had tracked the sudden rise of the privately held mainland firm.

Now the China Insurance Regulatory Commission (CIRC), which regulates the insurance industry on the mainland, is reportedly assembling a team to investigate the trophy-hunting company, Caixin, a respected Chinese business magazine, reported on Monday, citing an unnamed source.

Chinese ministries have been known to feed information to reporters ahead of official announcements, although it remains unclear in this case how the Beijing-based outlet sourced its information. In March, the same magazine also reported exclusively that the CIRC objected to Anbang’s deal to buy Starwood, citing a person familiar with the matter.

Anbang Jumps From Obscure Insurer Onto the Front Page

Anbang’s $14 bil bid for Starwood raised questions about the company’s capital sources and investment practices

Established in 2004 with car insurance as its main offering, Anbang had grown quickly in recent years, but as late as mid-2014 was still not among the country’s best known insurers. That anonymity evaporated in the heat of Anbang’s recent overseas buying spree, as it snapped up New York’s Waldorf Astoria hotel for $1.95 billion in late 2014 and later acquired Strategic Hotels & Resorts from Blackstone for $6.5 billion in March of this year. In the space of 12 years, Anbang, believed to have deep political connections, has morphed from a provincial startup into a global M&A player making deals spanning insurance, banking and financial services across three continents.

Did Flashy Deals Bring on Regulator Scrutiny?

The group’s overseas purchases have not gone unnoticed by regulators in China. In a sign of official wariness over the potential risks of such deals, the CIRC said last week that insurers looking to invest in other entities should first report their financing dealings, as part of a transparency push aimed at protecting insurance buyers and heading off risky deals.

In the case of Anbang, doubts center on its opaque financing and mysterious company structure. The Financial Times reported last month that Starwood had rebuffed Anbang’s proposal three times details of the company’s bid, including its financing. Anbang finally walked away from the deal, vaguely citing “ various market conditions.”

One company insider told the FT that the collapse of the deal is attributable to the recklessness of company boss Wu Xiaohui, who is married the granddaughter of China’s former leader Deng Xiaoping.

“He wants to create a real international Chinese company and to be the number one businessman in China, but he was not well prepared, and he did not listen to advice. He was too impatient to do the deal.” The insider said.

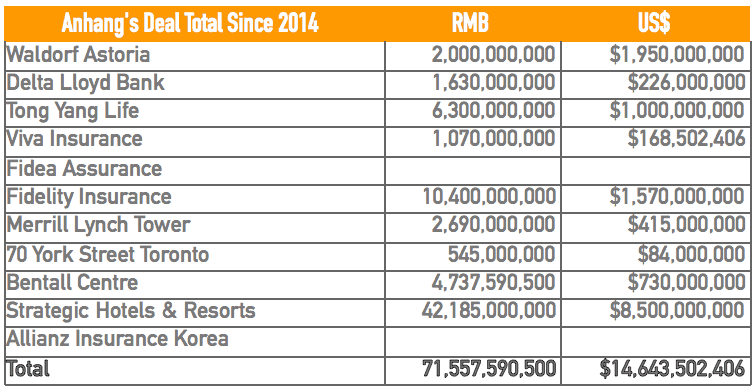

By the time of the attempted Starwood deal, Anbang had already acquired more than RMB71.5 billion ($12.6 billion) of overseas assets since 2014. And that total did not include its 2015 deal for Belgian insurer Fidea, the value of which was not disclosed, according to transactions tracked by Mingtiandi.

With the company declaring in February of this year that it has RMB 700 billion in total assets, its overseas holdings at the time of its Starwood bid, including its acquisition of Strategic Hotels and Resorts would have translated into 10.2 percent of its declared holdings. Since the Starwood deal fell apart, Anbang went on to buy the Korean branch of Germany’s Allianz Insurance for an undisclosed sum in early April.

The latest Caixin report did not give a date for the inspection by the CIRC, nor did it explain what part of the Anbang business would be examined. But it emphasized the inspection is aimed at better understanding the company.

According to a March report in the New York Times, Anbang quintupled its capitalisation in 2014, thanks largely to injections of billions of dollars in cash by an opaque network of shareholders, rather than by selling policies and then collecting premiums, as is the general rule with insurance institutions.

Shortly before Anbang’s about-face on its Starwood bid, the CIRC, as reported by Caixin in March, said that the acquisition would put the insurer in violation of Chinese laws that restrict insurance companies to investing no more than 15 percent of their assets abroad. The Caixin report on Monday said Anbang did not meet that requirement after calculating the group’s assets.

China’s outbound investment hit a record $118 billion in 2015, a jump of 14.7 percent over the previous year, according to data from China’s Commerce Ministry.

Leave a Reply