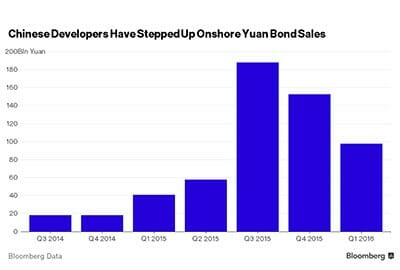

China has moved its bond sales back onshore since last year (Graphic by Bloomberg)

China’s financial markets bet big on property bonds as home sales take off in the first tier cities, while more analysts see the government tolerating a big city bubble if it means selling off unwanted housing in smaller communities. Plus Malaysia’s cross-straits neighbour raises questions about a mammoth Chinese reclamation project in Iskandar. Read on for all these stories and more.

Mainland Fund Managers Buy Up Property Bonds on Market Recovery

The home-buying frenzy in Shanghai and Shenzhen is spurring China’s fund managers to load up on property bonds.

Yuan-denominated real estate notes returned 2 percent this year, third only to electric and oil service companies among Chinese corporate securities, according to Bloomberg analysis of a Bank of America Merrill Lynch index. In a sign of confidence, Poly Real Estate Group Co. sold five-year notes at 2.96 percent on Feb. 23, eight basis points lower than the rate for debt issued by China Development Bank Corp., the nation’s biggest policy lender. Read more>>

China’s Destocking Efforts Seen Re-inflating Big City Bubbles

China’s “whack-a-mole” property market is making a comeback – but it seems the central government isn’t reaching for the hammer just yet.

Chinese authorities have been intensifying efforts to stimulate the property market since late 2014, concerned that prolonged weakness in sales and prices might worsen a supply glut in apartments in many cities and become a further drag on the economy. Read more>>

Oceanwide Takes $384M Stake in Wanda Movie Empire

Oceanwide Holdings Co Ltd, the real estate developer-turned financier and Internet player, plans to invest 2.5 billion yuan ($384 million) in two media and movie companies owned by Chinese property conglomerate Dalian Wanda Group Corp Ltd.

The firm’s wholly owned Oceanwide Equity Investment Management Ltd is planning to acquire 6.61 percent stake of Wanda Pictures and 7.59 percent of Qingdao Wanda Pictures. Read more>>

Hysan Sees Profits Rise 5.5% in 2015

Hysan Development, one of the largest commercial landlords in Causeway Bay, reported underlying profit rose 5.5 per cent last year but warned challenges lie ahead as a downturn in retailing is likely to continue.

The developer, which owns 4.1 million square feet of retail, office and residential investment properties in Hong Kong, announced core profit, excluding the revaluation gain on investment properties, amounted to HK$2.28 billion for the year to December. Read more>>

Country Garden Iskandar Project Said to Ignore Reclamation Issues

The mega Forest City project off Johor Baru seems to be going full steam ahead despite ongoing controversy over its reclamation plans and even as other developers have either shelved scheduled project launches or dropped them altogether.

Forest City’s China developer Country Garden has already started work on one of the four islands that will eventually comprise the largest mixed development in Johor Baru. The project has an estimated value of $58.3 billion and is slated to be completed in phases over the next two decades. Read more>>

Agile Property Reports 18.6% Jump in February Sales

Guangzhou-based property developer Agile Property Holdings Ltd. said it had generated a total of 3.45 billion yuan (MOP4.23 billion/US$528.7 million) for February, a month-on-month jump of 18.6 per cent compared to some 2.91 billion yuan in January.

According to the company’s filing with the Hong Kong Stock Exchange yesterday, the Chinese property developer pre-sold a total gross floor area of 337,000 square metres with an average selling prices of 10,251 yuan per square metre. Read more>>

Tune in again tomorrow for more news, and be sure to follow @Mingtiandi on Twitter for headlines as they happen.

Leave a Reply