As analysts attempt to peer into China’s future and predict at what point the government may step in to stoke up a cooling market, a former advisor to China’s central bank still sees stimulus measures as unlikely unless economic growth drops below seven percent per year.

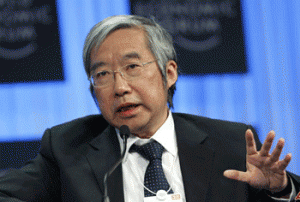

Speaking at a forum in New York recently, Yu Yongding, a former advisor to the People’s Bank of China (PBOC) and a current member of the Chinese Academy of Social Sciences approved of what he currently saw of China’s economic growth picture.

“China has yet to hit the rocks this year,” said Yu. “People are worried about a housing market collapse. This is not warranted.”Many experts predict that China’s government will announce on Jan 17 that fourth-quarter growth slowed to 8.7 percent.Annual growth of “8 percent or even 7 percent is OK,” Yu said. “A pace of less than 7 percent means crisis, economic and perhaps political crisis.”The biggest concern this year is any “dramatic” fall in real estate investment, which accounts for 9.9 percent of China’s gross domestic product, Yu said. That proportion is “way too high,” compared with countries like South Korea and Japan, he said.

So assuming that a Chinese government related speaker making pronouncements at an international forum represents the views of a significant slice of China’s economic leadership (which is usually a safe assumption), then the seven percent growth point is the figure to watch when trying to anticipate further government intervention on behalf of growth, potentially even including relaxing restrictions on the residential market.

Leave a Reply