In the past few weeks three Chinese cities have found ways to loosen restrictions on home sales and the force behind this trend can be found by tracking land purchases by the country’s top real estate developers.

In the past few weeks three Chinese cities have found ways to loosen restrictions on home sales and the force behind this trend can be found by tracking land purchases by the country’s top real estate developers.

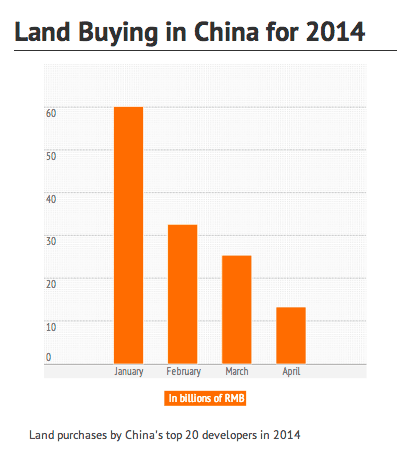

Since China’s home sales began to slow down this year, the nation’s property companies seem to have lost their appetite for new land purchases. According to data provided by real estate agency Centaline Property this crash diet has brought about a nearly 78 percent downturn in land expenditures by the top 20 real estate developers from January through April.

In January, the value of land purchased by the 20 real estate firms amounted to to RMB 60.1 billion (US$9.6 billion), in February it was RMB 32.6 billion (US$5.2 billion), in March it slid to RMB 25.4 billion (US$3.9 billion), and in April amounted only to RMB 13.3 billion (US$2.1 billion).

The drop in land sales is seen as the driving force behind recent moves in the cities of Tongling, Nanning and Wuxi to revise regulatory frameworks and boost property sales in their cities.

Increasing Pressure on Local Governments

According to the annual work report published by China’s Finance Ministry during March, the government planned on an 11.8 percent decline in land sales revenue this year. While it’s still possible for revenues to bounce back, at this point it appears that meeting that target will be a challenge.

Of course, much of the drop off in revenues may be caused by local governments hoping to delay auctions until land prices rise – something which is not likely to happen while housing prices are flattening out and developer profits are being squeezed.

Given the dependence of local governments on land sales revenues, holding back new plots from auction works best as a short term strategy. In 2013, land sales amounted to approximately 61 percent of local government revenues in China.

However, while local governments may need to turn to Beijing for financial support as their revenues fall, they are also likely to start putting pressure on the central authorities for some policy support.

Bending Housing Policies to Boost Sales

While fear of crossing national level regulators has prevented a mad rush to unlace the country’s corseted real estate market, as the government has take no steps to countermand the revisions put in place in Tongling, Nanning and Wuxi, other cities can be expected to follow suit in the near future.

Although Tongling and Nanning are relatively minor communities in China, the cities of Tianjin, Hangzhou and Changsha also all plan to stimulate the property market by loosening home-purchase limits or letting buyers get household registration, according to a report in the China Securities Journal.

As with any business that is experiencing a 78 percent drop in sales of a commodity that accounts for nearly two-thirds of their revenue, the pressure to make a change will be mounting daily, so stay tuned for more instances of local governments trying to loosen the strings on their housing markets.

[…] data appears to correlate with a report from competitor Centaline last month, which showed that land purchases by China’s 20 largest developers had fallen 78 percent during the first four months of the […]